Vintage cars show kicks off in London

Vintage cars show kicks off in London

Gorgeous scenery in NE China

Gorgeous scenery in NE China

Picturesque Barkol grassland in Xinjiang

Picturesque Barkol grassland in Xinjiang

Small Wild Goose Pagoda - A World Cultural Heritage Site along the Silk Road

Small Wild Goose Pagoda - A World Cultural Heritage Site along the Silk Road

Maritime Silk Road Luxuries of the Han Dynasty

Maritime Silk Road Luxuries of the Han Dynasty

Ciao! Chinese beauties!

Ciao! Chinese beauties!

An eye feast: BFA freshmen registration

An eye feast: BFA freshmen registration

Top 10 most lavish weddings

Top 10 most lavish weddings

Most amazing chi-pao beauties

Most amazing chi-pao beauties

Chinese lingerie brand arrives in Las Vegas

Chinese lingerie brand arrives in Las Vegas

|

| (Graphics:GT) |

China's economy is still growing within a reasonable range despite slowdown in a batch of economic indicators in August, the statistics bureau said over the weekend.

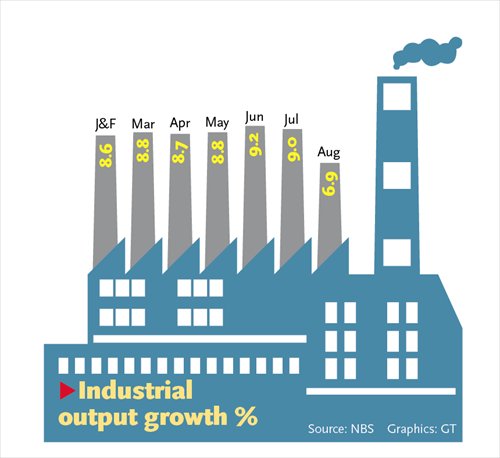

Industrial value-added output grew by 6.9 percent in August from a year earlier, down from 9 percent in July and the lowest reading since December 2012, according to data released by the National Bureau of Statistics (NBS) on Saturday.

Power output, another bellwether for economic activity, fell by 2.2 percent year-on-year in August, marking the first annual decline in more than four years, according to the NBS.

Urban fixed-assets investment rose by 16.5 percent year-on-year in the first eight months of this year, 0.5 percentage points lower than the first seven months, the NBS said.

Guo Tongxin, a statistician with the NBS, attributed the slowdown of these indicators to dampened external demand, high base effect, relatively low temperatures and slowing property market, read a statement posted Saturday on the bureau's website.

"Even taking the high base of last year into consideration, the slump in industrial production growth far exceeds our expectation," Xu Gao, chief economist of China Everbright Securities Co, told the Global Times Sunday.

As the drop in external demand and consumption growth is moderate, cooling investment is the major reason behind the economic slowdown, he said.

China's property investment growth moderated to 13.2 percent in the first eight months of this year, and new construction area and housing sales also fell, according to the NBS.

"The property market is related to 50-60 industries, so its slowdown has weighed on the manufacturing sector and investment," Lian Ping, chief economist with the Bank of Communications, told the Global Times Sunday.

Guo said in the statement that "it is normal to see fluctuations in some indicators," and stressed that there are favorable conditions for China to stabilize economic growth, including steady employment and consumer price index data, progress in industrial restructuring, stable consumption growth, as well as a booming services industry.

"China's economy is confronted with great downward pressure, but it still growing at a reasonable pace, and the country could achieve its annual economic goals," the statement said.

Lian expects economic data for the third quarter to be worse than the second quarter, predicting the GDP growth to slow to 7.3-7.4 percent in the third quarter from 7.5 percent in the previous quarter.

But the NBS statement indicates that a cut in interest rates or the reserve requirement ratio is unlikely in the near term, he noted.

China's broad money supply, also known as M2, grew 12.8 percent in August from a year earlier, data from the central bank showed Tuesday, which is down from 13.5 percent in July and below the government's target of 13 percent for the whole year.

Premier Li Keqiang told the Summer Davos Forum held in Tianjin last week that the government will not be distracted by short-term fluctuations of individual indicators, and China cannot rely on loose credit to stimulate the economy.

"The central government has showed greater tolerance for fluctuations in the economic growth," said Xu from Everbright Securities.

But with the economic growth further sliding close to the government's bottom line, Xu believes that the central authorities are likely to adopt easier policy stance, especially on monetary policy, within the year.

Appreciating red leaves in early autumn

Appreciating red leaves in early autumn Apple introduces larger iPhones, new watch

Apple introduces larger iPhones, new watch Chinese Buddhist Canon blesses Hong Kong

Chinese Buddhist Canon blesses Hong Kong Beautiful postgraduate teaches in remote area

Beautiful postgraduate teaches in remote area Amazing Guinness World Records

Amazing Guinness World Records Freshmen of Beijing Dance Academy take military training

Freshmen of Beijing Dance Academy take military training Chinoiserie architectures overseas

Chinoiserie architectures overseas Top 10 world's highest-paid models 2014

Top 10 world's highest-paid models 2014 Following the step of Zheng He

Following the step of Zheng He Childhood on grassland

Childhood on grassland Traditional Zhou dynasty style proposal

Traditional Zhou dynasty style proposal Tibetan students embrace new semester

Tibetan students embrace new semester Peace Mission 2014 joint military drill

Peace Mission 2014 joint military drill Sand painting world

Sand painting world Mind-boggling building looks like 'house of cards'

Mind-boggling building looks like 'house of cards'Day|Week|Month