The 4th Chinese National Pole Dance Championship held in Tianjin

The 4th Chinese National Pole Dance Championship held in Tianjin

Chinese navy commandos debut at 2014 RIMPAC

Chinese navy commandos debut at 2014 RIMPAC

Guangxi impression: scenic countryside

Guangxi impression: scenic countryside

World's largest aquatic insect found in Sichuan

World's largest aquatic insect found in Sichuan

Ceremony volunteers for Youth Olympics make public appearance

Ceremony volunteers for Youth Olympics make public appearance

A glimpse of female crew of Liaoning aircraft carrier

A glimpse of female crew of Liaoning aircraft carrier

Stills from "Dad, where are we going?"

Stills from "Dad, where are we going?"

Legless man's happy life

Legless man's happy life

Top ten most beautiful islands in China

Top ten most beautiful islands in China

Aerial view of Hong Kong

Aerial view of Hong Kong

Economic stabilization will boost market confidence

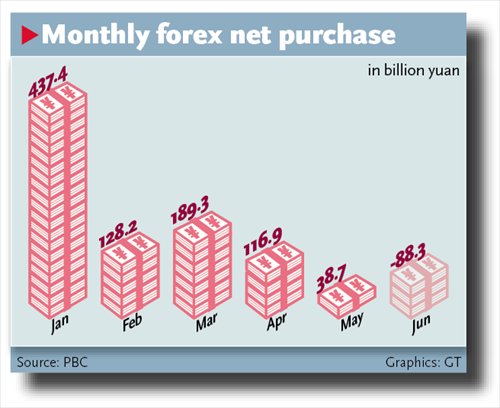

(Graphics:GT)

China may see more capital inflows in the second half of this year as the country's economy stabilizes and exports pick up amid improving global economic conditions, the State foreign exchange regulator said on Wednesday.

Guan Tao, an official at the State Administration of Foreign Exchange (SAFE), said at a press conference in Beijing that China's steady economic growth will "boost market confidence" and the interest rate differentiation will continue. These factors will attract foreign capital in the second half of 2014, he said.

China experienced a net capital inflow in the first six months of this year, the SAFE said on Wednesday.

Chinese individuals and enterprises sold 5.92 trillion yuan ($954.61 billion) of foreign currencies to banks in exchange for yuan, while they purchased 4.77 trillion yuan of foreign currencies in the first half of 2014, it said.

That resulted in a $188.3 billion half-year surplus in Chinese banks' yuan settlement, the regulator said, up 36 percent from $138.4 billion in the same period of last year.

Meanwhile, the People's Bank of China (PBC) and commercial lenders had net sales of 88.3 billion yuan of foreign currencies in June, the central bank said on Tuesday.

It was the first time for the bank to witness net sales in 10 months.

The figure is viewed as a proxy of foreign capital outflow, as most of the foreign currencies entering the country are sold to the central bank as a means of capital control.

Due to a number of uncertain factors such as the monetary policies of other major economies, "China's cross-border capital flows will continue to fluctuate in the second half of this year," Guan said. "The exchange rate of the yuan is heading toward an equilibrium. Under such circumstances, two-way capital flows will become a new norm," he said.

China's GDP growth inched up to 7.5 percent in the second quarter from an 18-month low of 7.4 percent in the first quarter, thanks to the governments' measures to stabilize the economy that boosted infrastructure investment and lending.

However, a Bloomberg poll showed on Wednesday that the country's efforts so far to stimulate the economy are insufficient to achieve the annual target of 7.5 percent.

According to Guan, China had a net capital inflow in the first quarter and outflow in the second quarter.

In the first quarter, investors expected the yuan to appreciate in the long run, so they used foreign currencies to purchase the yuan which led to capital inflows, Zhang Lei, a macroeconomic analyst at Minsheng Securities, told the Global Times on Wednesday.

However, the central bank was believed by analysts to have engineered a depreciation of the currency to curb speculation in February and March.

The PBC doubled the daily trading band of the yuan against the US dollar to 2 percent on March 15.

That motivated some investors who were bearish about the yuan's value to sell the currency in the second quarter, causing capital outflows, Zhang said.

Liu Dongliang, a foreign exchange analyst at China Merchants Bank, told the Global Times on Wednesday that China will have a small net capital inflow in the second half of 2014, as the yuan is expected to appreciate in a stable manner and the central bank hopes to maintain stable capital flows.

Meanwhile, foreign companies remain cautious about making investments in China considering the country's economic situation, so massive capital inflows are unlikely in the coming months, Zhang said.

Also, capital inflows will be further curbed by a weak euro and tighter monetary policy of the US, he added.

Zhujiang ambassadors attend lotus lanterns activity

Zhujiang ambassadors attend lotus lanterns activity

From girly girl to tough special police officer

From girly girl to tough special police officer

Children attend gymnastics training in summer

Children attend gymnastics training in summer

Beautiful sceneries along the special travel route in Xinjiang

Beautiful sceneries along the special travel route in Xinjiang

Focus on 1st female patrol team in Turpan

Focus on 1st female patrol team in Turpan

Collection of 'China Dream' public-spirited ads

Collection of 'China Dream' public-spirited ads  National fitness team members integrate traditional and modern beauty

National fitness team members integrate traditional and modern beauty Moms on their kid’s coming out

Moms on their kid’s coming out Chinese fighters through lens

Chinese fighters through lens

48 hours after super Typhoon Rammasun

48 hours after super Typhoon Rammasun Bikini show held at water park in Xi'an

Bikini show held at water park in Xi'an

Lobster vs cat: catch me if you can

Lobster vs cat: catch me if you can  Heat waves sweep China

Heat waves sweep China  Top 10 most beautiful islands in China

Top 10 most beautiful islands in China

Zhou Xun announces engagement to Archie Gao

Zhou Xun announces engagement to Archie Gao

Day|Week|Month