Ceremony volunteers for Youth Olympics make public appearance

Ceremony volunteers for Youth Olympics make public appearance

A glimpse of female crew of Liaoning aircraft carrier

A glimpse of female crew of Liaoning aircraft carrier

Stills from "Dad, where are we going?"

Stills from "Dad, where are we going?"

Legless man's happy life

Legless man's happy life

Top ten most beautiful islands in China

Top ten most beautiful islands in China

Aerial view of Hong Kong

Aerial view of Hong Kong

Happy life in Xinjiang

Happy life in Xinjiang

2014 China Hainan Int'l Automotive Exhibition kicks off

2014 China Hainan Int'l Automotive Exhibition kicks off

Collection of 'China Dream' public-spirited ads

Collection of 'China Dream' public-spirited ads

The silent holy stones

The silent holy stones

|

| (Graphics:GT) |

Slowdown to persist, says expert

The cooling real estate sector will be the biggest "uncertain factor" in China's slowing economy this and next year, a top official at a think tank under the country's cabinet said over the weekend.

Liu Shijin, deputy director of the Development Research Center of the State Council, said on Saturday that China's property market is going through a "historical turning point," and the demand for homes has peaked.

The growth of investments in the real estate sector will most likely be under 5 percent in the next few years, Liu noted.

China's property market embarked on a road of correction earlier this year, with the growth of home prices and sales starting to decline. The cooling home market added pressure to the country's slowing economy, which grew by 7.4 percent year-on-year in the first half of 2014.

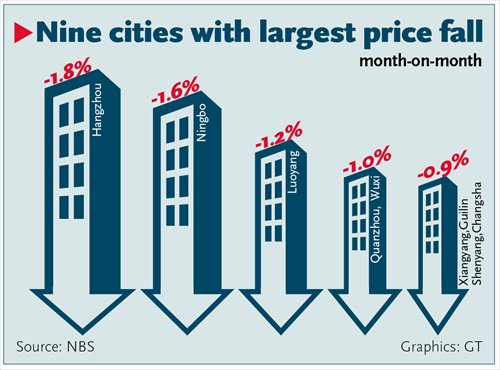

New home prices fell in 55 of 70 major Chinese cities in June month-on-month, the broadest drop since January 2011, the National Bureau of Statistics (NBS) reported on Friday.

Prices in Shanghai dropped by 0.7 percent in June compared to May, and Guangzhou, capital of South China's Guangdong Province, logged a price fall of 0.6 percent during the month, though prices in Beijing inched up by 0.1 percent.

"According to our research results, the current turning point is not a seasonal one. It will have a long-term impact," Liu was quoted as saying at a conference in Beijing by China Business News on Saturday.

Li Zhanjun, an analyst at Shanghai-based E-house China Research and Development Institute, told the Global Times on Sunday that Liu was "too pessimistic" and "there's no turning point of any kind."

"The drop in home prices and sales is a result of the slowing economy, which has affected the performance of almost every sector," Li said.

More than 4.2 trillion yuan ($677.24 billion) was invested in the real estate sector in the first half of 2014, the NBS reported on Wednesday, up by 14.1 percent from the same period of 2013. Some 2.87 trillion yuan was poured into the home market, up 13.7 percent year-on-year, the NBS said.

If China could achieve a GDP growth of 7.4 percent to 7.5 percent, the annual increase in real estate investments would be above 10 percent this year, Li said.

It would be normal if China's home prices drop by 10 percent to 15 percent in the next few years, said Gong Fangxiong, committee general manager of the Asia-Pacific Region at JPMorgan Chase.

"Many developers may exit the market as home prices tumble and the real estate sector reshuffles," Gong was quoted as saying by news portal wallstreetcn.com on Sunday. "About 10,000 developers will survive and perform better than now."

China's economic growth accelerated to 7.5 percent for the first time in three quarters in the three months from April to June, as the country's mini-stimulus measures to spur investments and lending took effect.

The country's GDP grew by 7.4 percent in the first quarter, the slowest in 24 years.

Zhang Hongwei, research director of Shanghai-based property consultancy TopSur, said in a research note e-mailed to the Global Times on Wednesday that China will try to unleash more demand with administrative measures to boost the slumping property market and the economy in the short run.

Several cities, including Tianjin, Wenzhou and Haikou, have announced adjustments to their home purchase curbs to augment local prices, while many others, such as Hangzhou and Shenyang, are expected to make changes soon, according to media reports.

Moms on their kid’s coming out

Moms on their kid’s coming out Chinese fighters through lens

Chinese fighters through lens

Children attend gymnastics training in summer

Children attend gymnastics training in summer

Beautiful sceneries along the special travel route in Xinjiang

Beautiful sceneries along the special travel route in Xinjiang

Beauty SWAT member in Xinjiang sparks online frenzy

Beauty SWAT member in Xinjiang sparks online frenzy

Germany beat Argentina 1-0 to win World Cup

Germany beat Argentina 1-0 to win World Cup

National fitness team members integrate traditional and modern beauty

National fitness team members integrate traditional and modern beauty Collection of 'China Dream' public-spirited ads

Collection of 'China Dream' public-spirited ads  How Chinese men kill the time when their wives practice square dancing?

How Chinese men kill the time when their wives practice square dancing? Top 10 most beautiful islands in China

Top 10 most beautiful islands in China

Zhou Xun announces engagement to Archie Gao

Zhou Xun announces engagement to Archie Gao

Photos of the Week

(July 6 - July 12)

Photos of the Week

(July 6 - July 12)

'Super moon' seen in Beijing

'Super moon' seen in Beijing

One-legged women with high heel goes viral on Internet

One-legged women with high heel goes viral on Internet China's largest 3D printer builds 2-meter-long boat

China's largest 3D printer builds 2-meter-long boat

Day|Week|Month