Weaker consumption and industrial output cited by Ministry of Finance

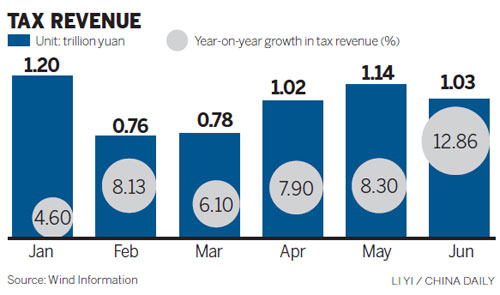

The government's tax income rose 7.9 percent year-on-year in the first half of the year, down from 9.8 percent in the same period last year, because of weaker industrial output and consumption amid an economic slowdown, the Ministry of Finance said on Monday.

The deceleration of tax growth may put a squeeze on the possibility of a fiscal stimulus - one of the crucial driving forces to avoid deepening economic slippage in the coming months, economists said.

In the first two quarters, the country's tax income amounted to 5.926 trillion yuan ($966 billion). The value-added tax increased 6.6 percent from a year earlier, 1.5 percentage points lower than that in 2012. Consumption tax rose 3.6 percent. It was 11.7 percent last year.

Meanwhile, corporate income tax growth slowed to 14.2 percent from 17.3 percent, the ministry said.

Gloomy industrial production, a fast fall in imports and the structural tax-reduction policy were seen as the main reasons dragging down tax income, according to the statement.

However, the tax income growth rate has been increasing every month consecutively since the second quarter - the year-on-year growth rate was 7.9 percent, 8.3 percent and 12.86 percent from April to June, the ministry said.

Zhu Haibin, chief economist in China with JPMorgan Chase & Co, said on Monday at a news conference the slowdown in industrial profit could limit any increase in tax income.

"However, we don't expect a large stimulus from boosting fiscal expenditure to support economic growth in the near future. The government still has room to adjust fiscal policy," Zhu said. "The key task for the leadership now is to push the economic rebalancing reform while ensuring the economy does not fall below the bottom line."

He expected the fiscal deficit by the end of this year may remain less than 1.2 trillion yuan, which was set as the annual target in March.

The National Bureau of Statistics has released the industrial profit growth rate for the first half of the year, showing an 11.1 percent increase, compared with a rate of 12.3 percent from January to May and a 5.3 percent rise for the whole of 2012.

The monthly industrial profit growth was 6.3 percent in June, down from 15.5 percent in May and 9.5 percent in April, according to the bureau.

According to the Ministry of Finance, value-added tax, which was mainly based on industrial output, amounted to 1.43 trillion yuan in the first half of the year, accounting for 24.2 percent of the whole tax volume.

Tax income from the mining industry declined 24 percent and that for the non-ferrous metals industry dropped 11.1 percent.

The figures are in line with the HSBC Purchasing Managers' Index, which has decreased for four straight months to 47.7 in July, down from 48.2 in June and 49.2 in May, showing contraction in the manufacturing sector, economists said.

"The weakness in manufacturing investment has been a major drag on economic growth in recent months," said Zhu from JPMorgan. "Hence tracking the trends in industrial profit growth as well as profit margins would be important in gauging the operating environment for the manufacturing sector looking ahead."

The State Council, the country's cabinet, hosted by Premier Li Keqiang, announced last Wednesday it would suspend value-added tax and business tax for more than 6 million small and micro-sized enterprises from August.

It is likely to decline 12 billion yuan this year, the Ministry of Finance said.

Zong Liang, deputy head of the International Finance Research Institute under the Bank of China, said the move could release more potential power to boost the industrial economy although, in the short term, the tax income will be slightly affected.

Teng Tai, chairman of West Brothers Asset Management Co Ltd, said currently the "most effective" measure to stabilize economic growth is to "largely" cut tax for small and medium-sized enterprises and reduce their financial costs because they can provide the most employment opportunities in the country.

3 killed, 5 injured in S China knife attack

3 killed, 5 injured in S China knife attack

![]()