Authorities in Guangzhou and Shenzhen, two large cities in Guangdong province, announced detailed regulations on Sunday to further cool the real estate market amid expectations of rising property prices this year.

According to the regulations, Guangzhou, the provincial capital, will provide land for residential use of up to 5.95 square kilometers this year, up 1.47 sq km compared with the average during the past five years.

Those without hukou (household registration ) in the city are permitted to buy houses after they have continually paid tax or social security fees there for one year or longer two years before they buy a house.

Houses for sale are advertised at a real estate agency in Beijing. The municipal government announced detailed rules on Saturday aimed at cooling the property market. LUO XIAOGUANG / XINHUA

"The measures are aimed at better cooling down the property market by providing more land for residential use," said Huang Wenbo, spokesman for the Guangzhou Land Resources and Housing Administrative Bureau.

Land for construction of small- and medium-sized dwellings will account for at least 70 percent of the total for residential use, according to the regulations.

The regulations in Guangzhou did not mention detailed measures to limit property prices. But Huang said the city's rules are strictly in line with the central government's policies.

"We will strictly implement the 20-percent tax on capital gains from property sales," he said.

In contrast, authorities in Shenzhen have planned to limit the price increase of new properties below the city's per capita disposable income target, which was set at 9 percent by the local people's congress earlier this year.

However, authorities in Shenzhen did not explain how they will implement the 20-percent tax on capital gains from property sales.

The southern special economic zone also planned to build some 40,000 units of affordable government-subsidized properties this year.

Before Guangzhou and Shenzhen's detailed rules, Beijing, Shanghai and Chongqing, along with Hefei in Anhui province and Xiamen in Fujian province, also announced on Saturday how they will implement the central government's regulatory plan set earlier in March.

In Beijing, single adults with the capital's hukou — household registration — are allowed to buy only one apartment, as opposed to two previously.

Meanwhile, banks in Shanghai will be banned from giving loans to residents who own two apartments and are attempting to buy more. The city will strictly follow the 20 percent tax policy and increase the down payment and mortgage rates for second-home purchases, depending on market conditions.

Zhou Feng, a senior manager with the real estate agent MyTopHome in Guangzhou, said transactions of secondhand properties in the city will decline after the rules are announced.

"A large number of residents sold their properties before the regulation finally took force. So transactions in the following months will decrease," he said.

Transactions of pre-owned homes in the city's Huangpu district have increased dramatically since the central government announced further policies to cool the real estate market, with deals for 2,680 homes signed, sources with the Guangzhou Municipal Land Resources and Housing Administrative Bureau said.

Due to relatively lower property prices in Guangzhou compared with Beijing and Shanghai, the regulations in the southern Chinese city were slightly loose, he said.

"Most buyers in Guangzhou have not owned property before. So there is high demand for houses, rather than investment property," Zhou told China Daily.

Internet users said the latest rules announced by major cities were just more of the same.

"For example, the Guangdong regulations are exactly the same as the central government's. They just repeated the policy. And I am worried that property prices will be even higher this year," said a micro blogger under the screen name "Woaiqiuying".

Microblogger "Laoaiguancha," a financial columnist for Sina.com, regarded the measures as too mild — sufficient to fulfill the central government's requirements but not to reduce home prices.

The micro blog of People's Daily expressed fears over the "fake divorce" trend in recent weeks in which couples who are "divorced" will try to remarry as soon as possible to take advantage of loopholes.

However, real estate agents such as Zhongyuan said the phenomenon was rare and people investing in real estate are unlikely to choose such a complicated and risky way to do business.

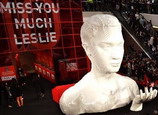

Exhibition marks 10th anniversary of Leslie Cheung's death

Exhibition marks 10th anniversary of Leslie Cheung's death

![]()