DUBAI, March 30 (Xinhua) -- Despite the setback in gold prices due to the euro zone's bailout of indebted Cyprus, the gold might see a comeback if unwelcome developments in the euro zone reoccur, said an expert on Saturday.

Gold prices fell over the last week by 12 U.S. dollars or 0.74 percent to 1,597 dollars.

In his weekly e-mailed commentary on precious metals, Gerhard Schubert, head of precious metals at bank Emirates NBD, said " Cyprus is done and dusted, at least for the gold trading community. "

The 17-member states comprising the currency union agreed on March 17 to bail out Cyprus with 10 billion euros (12.88 billion dollars) on the condition that bank accounts with capital less than 100,000 euros (128,000 dollars) are fully guaranteed by commercial banks. The Cypriote parliament permitted the plan Tuesday.

Schubert said the rhetoric concerning the Cypriot bail-out conditions might be a blueprint for further "rescues" which will not increase the confidence of the depositing euro zone population into leaving large amounts of cash within the euro banking system.

Regarding further support for the yellow metal, Schubert noted the list of central banks involved in any kind of gold related currency diversification is growing consistently. "These purchases are building some kind of backbone for the physical markets and that could help to strengthen the base building in the high 1,500 dollars levels."

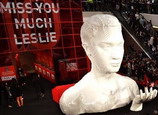

Exhibition marks 10th anniversary of Leslie Cheung's death

Exhibition marks 10th anniversary of Leslie Cheung's death

![]()