THE price of oil fell yesterday, as a drop in metals commodities overflowed to crude markets and stocks retreated from five-year highs.

Benchmark crude for April delivery lost US$1.88, or 2 percent, to finish at US$95.22 a barrel on the New York Mercantile Exchange. The March contract, which expires yesterday, fell US$2.20 to end at US$94.46 per barrel.

Brent crude, used to price many international varieties of oil imported by US refineries, fell US$1.92 to finish at US$115.60 a barrel in London.

Gold and other precious metals tumbled in yesterday trading, and oil was dragged down by the commodities sell-off. Gold was down about US$26, around 2 percent, to US$1,578 an ounce. Silver and platinum lost about 3 percent.

The stock market backed off yesterday as well, with the major indexes lower after minutes from the last Fed meeting showed some concern about the risk in the central bank's bond-buying stimulus policy.

Also yesterday the Commerce Department said housing starts slowed in January from December, although applications for building permits continued to rise, pointing to more recovery for the housing market this year. Many analysts expected the decline in January starts after a sharp rise in December, and most of the drop came in apartment construction. Single-family home starts were slightly higher last month.

Oil prices were undercut by analysts' expectations for higher US crude supplies when the Energy Department's Energy Information Administration releases its weekly inventory report on Thursday. Analysts on average forecast a rise of 2 million barrels, according to Platts, the energy information arm of McGraw-Hill Cos.

In other energy futures trading on the Nymex:

- Heating oil fell 2 cents to end at US$3.16 per gallon.

- Wholesale gasoline fell 6 cents to finish at US$3.06 per gallon.

- Natural gas rose 1 cent to end at US$3.28 per 1,000 cubic feet.

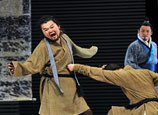

Employees run half-naked for not meeting sales quotas

Employees run half-naked for not meeting sales quotas

![]()