|

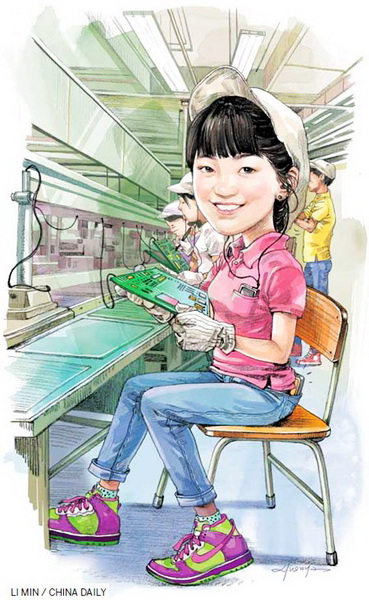

| China will still maintain labor cost advantage in foreseeable future. |

Maintaining the Edge

Although some of China's traditional advantages in attracting foreign investment are dwindling due to its rapid economic growth and increasing standard of living, the country's transformation of its development model would create new opportunities for foreign investors.

"While China's demographic dividend is declining, the cost-effectiveness of the Chinese labor force is increasing, and the huge potential of the Chinese market has yet to be unleashed," Shi Mingshen, a renowned economic observer, told this journalist.

"China's biggest attraction to global investment will be its vast market, compared with its long-time low labor cost," John Duggan, a veteran China watcher, told this journalist.

However, China's comparative advantage in low-cost labor will still exist for quite some time, since although the Chinese workers enjoy an average wage level higher than those of Vietnam and Laos, the level is still lower than that in Taiwan, Hong Kong, South Korea, Singapore, Brazil and other countries and regions, not to mention the European countries and the United States.

"Western companies looked to China as a place of outsourcing and production," said Andy Serwer, the managing editor of Fortune. "Now these trends are certainly continuing, but another important part, the consumer part, is making more weight."

As the traditional growth model driven by the dividends from huge inputs and low labor costs is no longer sustainable, China is accelerating the transformation of its old export-oriented development mode to one that is driven by consumption, allowing the domestic market and consumption to play a greater role in future growth.

According to Brenda Lei Foster, president of the American Chamber of Commerce in Shanghai (Amcham Shanghai), small and medium-sized US firms are being encouraged to boost their exports by cashing in on China's increased domestic consumption.

Foster said that US companies will continue to tap China's demand for sophisticated, innovative US products, including services, as the country makes the transition from an export-intensive economy to one driven by higher value-added production and domestic demand.

The widening consumer base offers a "compelling destination for US small and medium-sized enterprises (SMEs) to boost exports or expand their business", based on the Amcham Shanghai report entitled Viewpoint: Opportunities for US Small and Medium Business in the China Market.

"The opportunity is so great that simply doubling the number of US SMEs that export to 2 percent worldwide would result in approximately $400 billion in additional exports and approximately 2 million American jobs," the report said.

"The Chinese market is really maturing. I think US companies are optimistic about their prospects in China," said Foster.

According to US global management consulting firm McKinsey & Company, China's expanding middle class is expected to reach 400 million in 2020.

President Hu Jintao stated in his report to the 18th CPC National Congress that by 2020, the per capita income for both urban and rural residents should be double that of 2010.

It is estimated that approximately 64 trillion yuan ($10.2 trillion) will be released should China double its average personal income by 2020, and the export-driven economic power will turn into a large consumer market that injects new power into the global economy.

Spectacular images of erupting volcanoes

Spectacular images of erupting volcanoes

![]()