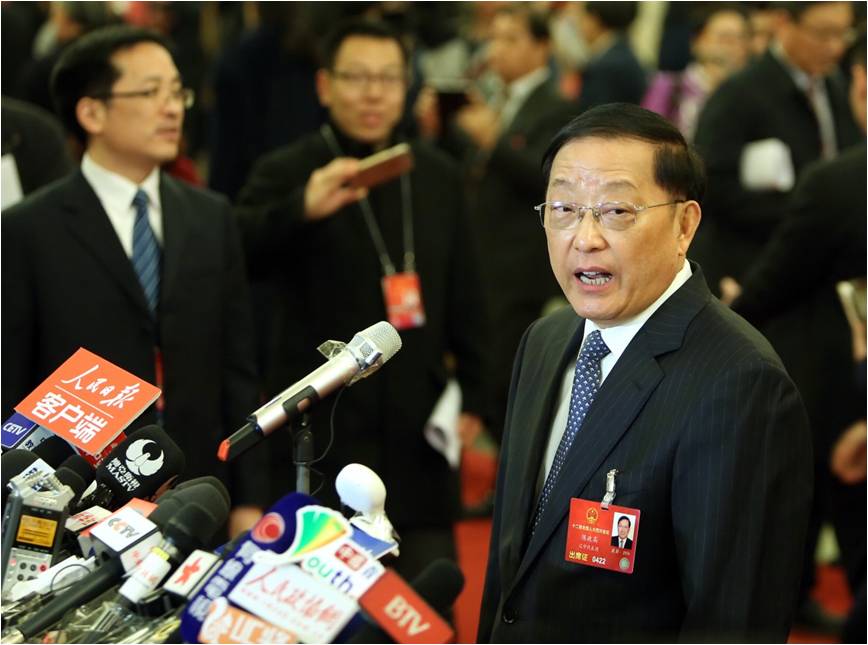

Chen Zhenggao, Minister of Housing and Urban-rural Development, gives an interview to media on Saturday before the fourth session of the 12th National People’s Congress kicked off at the Great Hall of People. (Photo: Shi Jiamin from People’s Daily)

China’s Premier Li Keqiang gave the remedy to China’s housing market as he opened China's annual legislative sessions on Saturday, pledging more efforts to construct affordable housing projects and pursue a stable and healthy real estate market.

Chinese government will improve tax and credit policies that encourage rational housing consumption, focus on meeting rigid demand, and reduce housing inventory by adopting measures that apply to different cities, which was stressed in the government work report Premier Li delivered at the opening meeting of the fourth session of the 12th National People’s Congress.

Policies will focus on both housing rental and purchase, and some floating populations will be granted to public rental properties step by step, Li added.

Li’s reassurance, coming when domestic and international observers are watching how China will stabilize its property market, reveals the importance China attaches to a healthy market, a barometer of the macroeconomic situation.

A series of favorable policies introduced by China since the second half of last year to reduce inventory boosted market confidence, but the rising transactions and prices in some first-tier cities after the Spring Festival this year triggered concerns.

China's central bank on March 1st cut the reserve-ratio requirement for banks by 0.5 percentage points. The market read the move as an implication of loose monetary policy.

Chen Zhenggao, Minister of Housing and Urban-rural Development, noted that the authoritative body has been keeping a vigilant eye on the fluctuation of housing prices in four first-tier cities, and closely contacts with their local governments.

The four first-tier cities, Beijing, Shanghai, Guangzhou and Shenzhen, are trying to cool the market by imposing measures such as strict sales restrictions and differential taxation policies, Chen said when attending the fourth session of the 12th National People’s Congress.

The supply of land and apartments, especially small and medium-sized ones, would be increased, while the authorities would crack down on irregularities in transactions, the housing minister stressed, adding that information on land supply will be timely released to the public.

The major task to the country’s property market is to destock, Zhu Guangyao, China’s Vice Finance Minister, commented on the rise of home prices in first-tier cities, refuting those viewpoints claiming a property bubble will arise in China.

Given the complexity of China’s economy, a holistic view must be adopted when analyzing the markets of first-, second- and third-tier cities, he stressed, adding that the market dynamics must be closely watched.

He also called for confidence in the market, saying that present trend proves that the demand is increasing, at least in first-tier cities.

The photo, posted online by netizens, was taken on people in queue in front of an estate trading center in Shanghai after Spring Festival. (Photo: Wechat account named “Hello, Shanghai” )

Day|Week

Qiandaohu supply ship named 'model ship' by PLA Navy

Qiandaohu supply ship named 'model ship' by PLA Navy Stunning Kuche on the Silk Road

Stunning Kuche on the Silk Road Tunisian man creates art of sand in Hangzhou

Tunisian man creates art of sand in Hangzhou Goddess teacher shares fitness program online

Goddess teacher shares fitness program online Getting close to PLA's easternmost post on the mainland

Getting close to PLA's easternmost post on the mainland 'Naked run' race held in Beijing

'Naked run' race held in Beijing Train Attendant Recruitment Held in East China

Train Attendant Recruitment Held in East China In pics: Russia's Su-35 fighter jets

In pics: Russia's Su-35 fighter jets Young monks learn kungfu in NE China temple

Young monks learn kungfu in NE China temple Scenery of Guzhu, thousand-year-old ancient village in E China

Scenery of Guzhu, thousand-year-old ancient village in E China