According to the information on its website, Fitch Ratings has recently raised the long-term issuer default rating and senior unsecured rating of Bright Food Group from ‘BBB-’ up to ‘A –’. Fitch Ratings raised the senior bonds issued by Bright Food Hong Kong Limited, indirect wholly-owned subsidiary of Bright Food Group, and guaranteed by Bright Food Group, from ‘BBB-’ up to ‘A –’. Rating outlook is stable.

It is reported that Fitch Ratings raised the rating of the issuer after reevaluating the relationship between State-Owned Assets Supervision and Administration Commission of Shanghai Municipal Government (Shanghai SASAC) and Bright Food Group, which proves that the rating methodology of Fitch Ratings on Bright Food Group has changed from “from bottom to top” to “from top to bottom.” Currently, Bright Food Group’s ‘A –’ rating is correlated with the credit level of Shanghai SASAC.

Fitch Ratings has pointed out that in May 2015 after the Government allocated Shanghai Liangyou Group free of charge to Bright Food Group, the correlation between Bright Food Group and Shanghai SASAC has been strengthened noticeably. The asset allocation of this time shows that the Shanghai Government has the intention to incorporate the state-owned agricultural resources of the city, clearly embodies the support of the Government toward Bright Food Group, and further strengthens the strategic status of the Group in aspects of food production, supply and marketing and quality assurance. After this time’s asset allocation, Bright Food Group shall be responsible for managing more than 80% of policy grain reserves and all policy edible oil reserves in Shanghai. This time’s allocation has also enabled the industry chain of Bright Food Group to extend to the upstream grain cultivation and procurement and logistics transportation and downstream retail distribution. Shanghai SASAC defines Bright Food Group as a competitive state-owned enterprise, but as the main “vegetable basket project” enterprise in Shanghai, the Group plays a key role in people’s livelihood and social stability in Shanghai. Bright Food Group plays a highly strategic role in ensuring adequate and reliable food supply and stabilizing local food price. The Group holds a dominant market position in aspect of food supply, covering about 70% of the market share in vegetable supply of Shanghai, 90% for fresh milk, and 70% and 35% for sugar and pork, respectively. The Group has about a local employment population of 100,000 in Shanghai. In light of Bright Food Group’s strategic significance, Shanghai SASAC has always held 100% of the Group’s shares.

Fitch Ratings believes that during the first half of 2015, Bright Food Group acquired 76.7% of the shares of Tnuva, the biggest dairy product manufacturer in Israel at one billion Euro of trading on price. The Group plans to raise no more than RMB13 billion of directional additional income to reduce partial debts through its publically traded subsidiary in 2015. As estimated by Fitch Ratings, should the price be suitable, the Group remains to seek the opportunity to acquire high-quality, reliable agricultural resources. In 2015, the income growth of Bright Food Group is about 20%.

Construction of HK-Zhuhai-Macao Bridge enters final stage

Construction of HK-Zhuhai-Macao Bridge enters final stage Model of heavy-lift copter makes debuts at Tianjin expo

Model of heavy-lift copter makes debuts at Tianjin expo Art photos of Chinese beauty in Han Chinese clothing

Art photos of Chinese beauty in Han Chinese clothing Stunning photos of air show in China’s V-Day parade

Stunning photos of air show in China’s V-Day parade Models change clothes on street in Hangzhou

Models change clothes on street in Hangzhou Charming Chinese female soldiers

Charming Chinese female soldiers Beauty vs. muscular man

Beauty vs. muscular man World's passenger plane giants convene in Beijing aviation expo

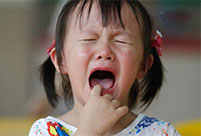

World's passenger plane giants convene in Beijing aviation expo First day in kindergarten

First day in kindergarten The gravy train

The gravy train Training tumblers

Training tumblers Is Hillary copying Trump to chase votes

Is Hillary copying Trump to chase votes Sport marketing crossover by Chinese industry giants

Sport marketing crossover by Chinese industry giantsDay|Week