Bikini show in 2014 China Final of Miss Tourism World

Bikini show in 2014 China Final of Miss Tourism World

Close-up view of August Aerobatic Team

Close-up view of August Aerobatic Team

Goddesses married in 2014

Goddesses married in 2014

Polar region photos raise worldwide awareness of global warming

Polar region photos raise worldwide awareness of global warming

Get off at the last stop — Beijing Subway in vision

Get off at the last stop — Beijing Subway in vision

Top 100 beauties in the world!

Top 100 beauties in the world!

Gallery: Who is the most beautiful one?

Gallery: Who is the most beautiful one?

If you like autumn, put your hands in the air!

If you like autumn, put your hands in the air!

Fan Bingbing's "Queen style" in new play

Fan Bingbing's "Queen style" in new play

Lingerie show at 2014 Miss China

Lingerie show at 2014 Miss China

|

| Graphics: GT |

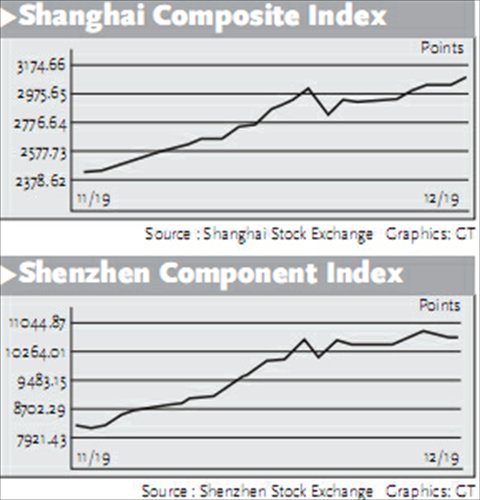

China's benchmark stock index climbed beyond the 3,100 points to hit the highest level in more than four years on Friday, led by construction, steel and electricity following a sharp dive last week.

Analysts warned that the recent bull run of the stock market could not be sustained if economic growth further slides, investors continue to speculate in heavyweight shares and blue chips continues to be undervalued.

The benchmark Shanghai Composite Index rose 1.67 percent to close at 3,108.6 points, the highest level since November 11, 2010 when it hit 3147.74 points.

The index extended this week's rise to 5.8 percent and continued six weeks of winning streaks following the launch of a pilot program to connect the Shanghai and Hong Kong stock markets. It also came after a decision on November 21 by the country's central bank to cut the interest rates for the first time in two years.

The Shenzhen Component Index, the country's second largest bourse, closed at 10,627.11 points, edging down 0.36 percent on Friday.

Total turnover on the two bourses expanded to 801.23 billion yuan ($131 billion) from Thursday's 739.49 billion yuan.

"The recent surge of the stock market reflects the investors' confidence in China's economic growth in the long term," Li Daxiao, chief economist at Shenzhen-based Yingda Securities, told the Global Times Friday.

"But there are always two sides to the coin. The benchmark stock index rose too fast from 2,000 points to more than 3,000 points in such a short time. Risks will remain if blue chips remain undervalued and given that reforms of the country's stock market such as an IPO registration system and delisting mechanism have not taken place," Li said. Friday's surge was backed by construction, steel and electricity stocks. China State Construction and China Railway Construction Corp soared by the daily limit of 10 percent to 6.88 yuan and 13.04 yuan. Maanshan Iron & Steel Company and Bao Steel also rose by the daily limit.

"The recent strong performance of the stock market was mainly driven by investors' speculation on heavyweights such as infrastructure construction, steel and machinery companies," Dong Dengxin, director of the Financial Securities Institute of Wuhan University of Science and Technology, told the Global Times.

"The launch of the Shanghai-Hong Kong Stock Connect program triggered the surge of the stock market but it won't last beyond the Chinese New Year since the economy is still facing downward pressure and the foundation for a strong stock market is weak," Dong said.

Friday's rally came as China revised the size of its economy in 2013 up by 3.4 percent to an estimated 58.8 trillion yuan ($9.6 trillion) for the year, according to the result of the latest nationwide economic census released by the National Bureau of Statistics (NBS) on Friday.

The tertiary industry, or the service sector, made up 46.9 percent of 2013 GDP, rising from an initial estimate of 46.1 percent, while secondary industry, which includes the industrial and construction sectors, accounted for 43.7 percent, down from 43.9 percent in the previous estimate. The proportion of primary industry in the GDP was 9.4 percent, down from 10 percent.

"The revision of the GDP for 2013 could affect the size of 2014 GDP but will not affect GDP growth for 2014," the NBS said in a statement.

China's economic growth slowed to 7.3 percent in the third quarter from a year earlier, down from 7.5 percent in the second quarter and the slowest pace since the first quarter of 2009.

"The relatively small upward adjustment, compared with previous census revisions, won't make a huge difference to how the economy is viewed or to key metrics, such as China's debt to GDP ratio. Nonetheless, it does provide some positive news on rebalancing," Julian Evans-Pritchard, a China economist at Capital Economics in Singapore, a macroeconomic research company said in a research note e-mailed to the Global Times Friday.

"The improvement in industrial structure does not ease the pressure on the government to bolster the slowing economy dragged down by weak property market and still serious problems of industrial overcapacity. The stock market and investors will suffer if the economy further falls," Dong said.

Joint anti-piracy drill

Joint anti-piracy drill Unknown 'monster' fish caught in Shandong

Unknown 'monster' fish caught in Shandong 20 years on: Relocated Three Gorges residents through lens

20 years on: Relocated Three Gorges residents through lens Beautiful Chinese woman

Beautiful Chinese woman Chestnut girl goes viral online

Chestnut girl goes viral online PLA HK Garrison veterans leave behind beautiful smiles

PLA HK Garrison veterans leave behind beautiful smiles Victoria's Secret Fashion Show

Victoria's Secret Fashion Show Representative beauties

Representative beauties Excellent photos of Zhuhai Air Show

Excellent photos of Zhuhai Air Show Thaw in US-Cuba ties offers broad lessons

Thaw in US-Cuba ties offers broad lessons China keeping close eye on ruble

China keeping close eye on ruble Macao’s relations with mainland strong despite Hong Kong protests

Macao’s relations with mainland strong despite Hong Kong protests Chinese literature steps up going abroad while online literature booms

Chinese literature steps up going abroad while online literature boomsDay|Week|Month