China's commercial banks will see their bad loan ratio remain generally stable and slightly retreat in the coming quarters, a report released by China Orient Asset Management predicts.

In the fourth quarter of 2016, Chinese lenders' non-performing loan ratio declined for the first time since 2012 to 1.74 percent, suggesting that loan losses posing risks to the country's financial market are easing.

The ratio stood unchanged in the first three months of 2017.

Citing results from sample surveys and data analysis, the report concluded that the banks' bad loan ratio would remain stable from the second quarter of 2017 to the first quarter next year.

But as China pushes ahead with economic structural upgrades, the ratio would still face upward pressure, the report added.

China Orient Asset Management is one of the country's four asset management companies set up in 1999 to deal with the toxic assets of state-owned banks in a bid to help them transform to market-oriented financial institutions.

Picturesque summer scenery of Tuohulasu Prairie in Xinjiang

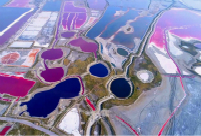

Picturesque summer scenery of Tuohulasu Prairie in Xinjiang Colors of summer: Yanhu lake transforms into muti-colored pools

Colors of summer: Yanhu lake transforms into muti-colored pools China’s high-speed railway now offers food at the click of a button

China’s high-speed railway now offers food at the click of a button New uniform coming to PLA

New uniform coming to PLA Gambler or dreamer?

Gambler or dreamer? China is world’s largest renewable energy producer, consumer

China is world’s largest renewable energy producer, consumer Chinese base in Djibouti not military expansion

Chinese base in Djibouti not military expansion Legislation needed to protect China’s dark sky resources

Legislation needed to protect China’s dark sky resources China’s domestic airlines' carrying capacity beats the US

China’s domestic airlines' carrying capacity beats the US Top 10 most sustainable cities in China

Top 10 most sustainable cities in China Top 10 European patent applicants in 2016

Top 10 European patent applicants in 2016 The power of 'She' in China

The power of 'She' in China Seven most beautiful art museums in China

Seven most beautiful art museums in China Falling approval rate tolls bell for Abe’s rule

Falling approval rate tolls bell for Abe’s rule After student’s disappearance, Chinese public point the finger at ‘inefficient’ US police

After student’s disappearance, Chinese public point the finger at ‘inefficient’ US police  Walkers hit by taxi highlight sports facilities shortage

Walkers hit by taxi highlight sports facilities shortage  Govt financial meeting triggers stock overreaction

Govt financial meeting triggers stock overreaction Day|Week