A residents shows China's yuan and US dollar banknotes in Qionghai, South China's Hainan province, Jan 7, 2016. [Photo/Xinhua]

China's nonfinancial outbound direct investment to the United States soared by 235.7 percent in the January to April period from the same period a year ago, underscoring Chinese investors' increasing appetite for US companies, data from the Ministry of Commerce showed on Tuesday.

Analysts said the mature market infrastructure and sound legal system of the US market, as well as the access to high-tech companies, were among the driving forces behind the trend.

Xu Hongcai, director of the economic research department at the China Center for International Economic Exchanges, said the growing trend of Chinese investors making the US a popular investment destination would likely continue after official data showed a record $8.39 billion of Chinese ODI in the US last year.

This year high-profile deals have included insurance conglomerate Anbang Insurance Group's $8.2 billion acquisition of US luxury hotel owner Strategic Hotels &Resorts, Tianjin Tianhai Investment Co Ltd's $6 billion purchase of US electronics distributor Ingram Micro Inc, as well as Haier Group's $5.4 billion buyout of the appliance unit of General Electric Co Ltd.

A recent report by nonprofit organization the National Committee on US-China Relations and research firm Rhodium Group predicted that 2016 would be another record year for Chinese investments in the US. It said this was driven by the desire to gain access to the explosion of technological innovation, as well as the urge to tap the growing spending power of domestic middle-class consumers by investing in tourism and hospitality.

The economic slowdown, industrial overcapacity, as well as the uncertainty of the renminbi's exchange rate have accelerated outbound investment by Chinese companies.

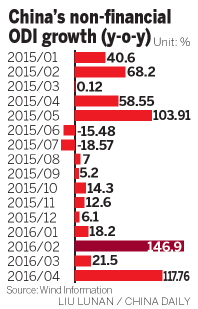

China's total nonfinancial ODI surged by 71.8 percent from the previous year to $60 billion in the first four months of this year, according to the Ministry of Commerce.

Besides the US, Australia was another major destination for Chinese outbound investment, which jumped 188.1 percent year-on-year. It was followed by the 83.9 percent ODI growth in Hong Kong and 21.5 percent increase in the member states of the Association of Southeast Asian Nations.

Chinese companies also invested a total of $4.91 billion in 49 economies involved in the Belt and Road Initiative in the January to April period. The value rose 32 percent from the same period last year.

Official data also showed that China's outbound investment in the service sector grew 73.2 percent to $43.8 billion, accounting for 73 percent of the total ODI.

However, Chinese investment in the European Union decreased 44.8 percent from the same period of last year, which analysts said may have something to do with the rising protectionism in the region.

French girl ties the knot with Chinese boy

French girl ties the knot with Chinese boy Beijing Style: ready for bare legs

Beijing Style: ready for bare legs Century-old station sees railyway evolution

Century-old station sees railyway evolution Enthusiasts perform Kung Fu at Wudang Mountain

Enthusiasts perform Kung Fu at Wudang Mountain Stunning photos of China's fighter jets in drill

Stunning photos of China's fighter jets in drill Monk's mummified body to be made into a gold Buddha statue

Monk's mummified body to be made into a gold Buddha statue Former Chinese solider of the French Foreign Legion seeks wife online

Former Chinese solider of the French Foreign Legion seeks wife online Asia's longest and highest suspension bridge to open to traffic

Asia's longest and highest suspension bridge to open to traffic China's first interactive robot looks like a beauty

China's first interactive robot looks like a beauty Top 20 hottest women in the world in 2014

Top 20 hottest women in the world in 2014 Top 10 hardest languages to learn

Top 10 hardest languages to learn 10 Chinese female stars with most beautiful faces

10 Chinese female stars with most beautiful faces China’s Top 10 Unique Bridges, Highways and Roads

China’s Top 10 Unique Bridges, Highways and Roads EU decision seen harming China ties

EU decision seen harming China ties Society firmly rejects Cultural Revolution

Society firmly rejects Cultural Revolution Villagers living near Vietnam border are still haunted by war’s legacy

Villagers living near Vietnam border are still haunted by war’s legacy As Chinese sci-fi picks up steam, it’s finding fans around the world

As Chinese sci-fi picks up steam, it’s finding fans around the worldDay|Week