BEIJING, July 9 -- China's central bank said Thursday it will continue to support liquidity need of China Securities Finance Corporation Limited (CSF), the national margin trading service provider, to stabilize a tumbling stock market.

The People's Bank of China (PBOC) said it has made sufficient re-lending to the CSF and approved the latter to issue short-term financial bonds in the interbank market to replenish liquidity.

The CSF is the only institution to provide margin financing loans to securities companies. It has offered 260 billion yuan (42 billion U.S. dollars) of stock-secured credit for 21 brokerage firms to conduct self-run share purchasing on the market.

The PBOC is trying to guide more capital into the market to rein in a continued plunge and restore investors' confidence as Chinese shares have been in a downward spiral since hitting a peak in June. The benchmark Shanghai Composite Index has shed more than 30 percent.

Campus belle in HK goes viral online

Campus belle in HK goes viral online Lugou Bridge in 78 years: July 7 incident

Lugou Bridge in 78 years: July 7 incident Get ready for the world's most thrilling water rides

Get ready for the world's most thrilling water rides Evolution of Chinese beauties in a century

Evolution of Chinese beauties in a century Creative graduation caps of ‘vigorous elves’

Creative graduation caps of ‘vigorous elves’ Typhoon class strategic Submarine in photos

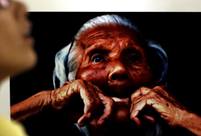

Typhoon class strategic Submarine in photos Japan’s crimes committed against "comfort women"

Japan’s crimes committed against "comfort women" Legendary life of a bee-keeping master in Hainan

Legendary life of a bee-keeping master in Hainan 4-year-old cute 'monk' spends summer holiday in temple

4-year-old cute 'monk' spends summer holiday in temple Top 10 most competitive Chinese cities in Belt and Road Initiative

Top 10 most competitive Chinese cities in Belt and Road Initiative Top 10 travel destinations in the world

Top 10 travel destinations in the world Xi talks peace at war memorial

Xi talks peace at war memorial Vietnam-US bond less rosy than it appears

Vietnam-US bond less rosy than it appears Furry funeral

Furry funeral Infrastructure investment boosted to stabilize growth

Infrastructure investment boosted to stabilize growth Day|Week