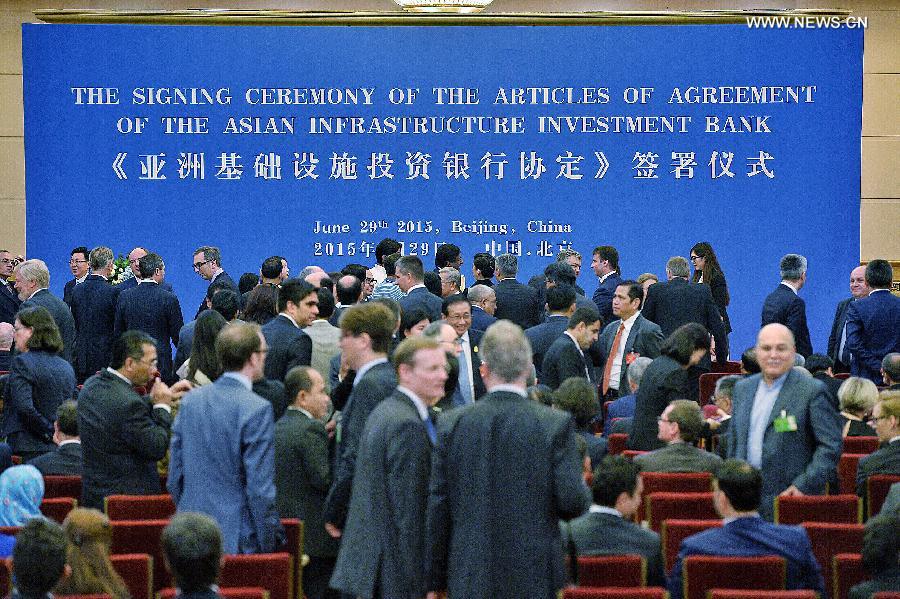

Representatives of prospective founders of the Asian Infrastructure Investment Bank (AIIB) prepare to attend the signing ceremony of the articles of agreement of AIIB in Beijing, capital of China, June 29, 2015. (Xinhua/Li Xin)

BEIJING, June 29 (Xinhua) -- Delegates of the 57 prospective founding countries of the Asian Infrastructure Investment Bank (AIIB) on Monday gathered in Beijing for the agreement signing ceremony, which will lay the legal framework for the China-initiated multilateral institution.

The 60-article agreement outlined the financial share of each member, policy making, business and operational systems, and governance structure. The AIIB is designed to finance infrastructure building in Asia.

Australia was first to sign the agreement in the Great Hall of the People.

The AIIB will have authorized capital of 100 billion U.S. dollars. Asian countries will contribute up to 75 percent of the total capital and be allocated a share of the quota based on their economic size.

China, India and Russiaare the three largest shareholders, with a voting share of 26.06 percent, 7.5 percent and 5.92 percent, respectively.

China does not seek a veto power in the bank, Vice Finance Minister Shi Yaobin said in an interview with Xinhua, adding that the country's stake and voting share in the initial stage are "natural results" of current rules, and may be diluted as more members join.

The Beijing-headquartered bank will start operation at the end of the year under two preconditions: At least 10 prospective members sign the agreement, and the initial subscribed capital is no less than 50 percent of the authorized capital.

4-year-old cute 'monk' spends summer holiday in temple

4-year-old cute 'monk' spends summer holiday in temple College graduates shining on the red carpet in Nanjing

College graduates shining on the red carpet in Nanjing PLA soldiers launch guided missiles in confrontation exercise

PLA soldiers launch guided missiles in confrontation exercise One woman’s fight against dog eaters

One woman’s fight against dog eaters Beautiful and smart - post-90s college teacher goes viral

Beautiful and smart - post-90s college teacher goes viral Top 10 luxury houses in the world

Top 10 luxury houses in the world  National Geographic: best photos during journey

National Geographic: best photos during journey Couples who engage in meaningful and deep conversations are happier

Couples who engage in meaningful and deep conversations are happier Maldives resort rated best hotel of 2015

Maldives resort rated best hotel of 2015  Global attitude poll reinforces old thinking

Global attitude poll reinforces old thinking Luxembourg scholar explodes myths about Tibet independence

Luxembourg scholar explodes myths about Tibet independence Smuggled meat came via Vietnam: official

Smuggled meat came via Vietnam: official Mentally ill confined at home due to lack of resources and public education

Mentally ill confined at home due to lack of resources and public educationDay|Week