In pics: YOG prism

In pics: YOG prism

Amputee girl reaches top of half-left tower in Jiangxi

Amputee girl reaches top of half-left tower in Jiangxi

Yardangs in Lop Nur

Yardangs in Lop Nur

Intoxicating Ayding Lake in Xinjiang

Intoxicating Ayding Lake in Xinjiang

Beijing's MJ impersonator a 'thriller' for crowds

Beijing's MJ impersonator a 'thriller' for crowds

Armed police compete on the plateau

Armed police compete on the plateau

Rubber Duck settles in Guiyang new urban area

Rubber Duck settles in Guiyang new urban area

Rare set of giant panda triplets turn one month old

Rare set of giant panda triplets turn one month old

Closing ceremony of Youth Olympic Games

Closing ceremony of Youth Olympic Games

Attractive posters to welcome freshmen

Attractive posters to welcome freshmen

SHANGHAI, Sept. 2 -- China's efforts to shake up its state sector are now targeting the paychecks of those running the country's state-owned firms.

The Political Bureau of the Communist Party of China (CPC) approved a plan last week to reform the payment packages of top executives at China' s large state-owned enterprises (SOEs) and detailed measures to regulate executive salary and corporate expenses.

For years, the yawning gap between what is paid to top executives and average workers at these companies has led to discontent among the public.

Senior executives at these firms make an average of 700,000 yuan (113,636 U.S. dollars) per year. Those working in the country's financial sector earn millions of yuan in salary alone, before bonus and reimbursement for corporate expenses. In some cases, executive pay remains the same despite shrinking profits at their firms.

The move to close the gap between top executives at state firms and average workers is part of a broader plan to reform the inefficient state sector by attracting private investment and hiring more qualified professionals to manage the firms in an increasingly market-based economy.

Broad guidance on regulating SOE executive pay was issued by several government agencies in 2009 but are viewed as having limited impact since it only introduced an across-the-board payment solution. The latest plan has articulated that it would establish a differentiated payment distribution scheme based on the nature of these enterprises and in line with the selection of executives.

Analysts say the new scheme would distinguish between SOEs operating in competitive industries, where bigger pressures demand adjusted wages, versus those mainly serving public interest. The scheme would design pay packages and incentives accordingly. Different payment standards will also apply to professional managers hired to run the company and executives appointed by the government.

A key theme in the ongoing reform of China's SOEs has been promoting mixed ownership through private investment as well as allowing staff to hold company shares. This has, in part, shifted the focus more toward improving the return generated from state capital and less on running the company, authorities said.

Chinese leadership vowed to let the market play a decisive role in the economy after a CPC national plenum laid out a wide-ranging reform plan to put the world's second-largest economy on a more sustainable track.

The plan also promised to improve corporate governance and hire professional managers to oversee day-to-day operations, while government officials may be appointed as board members to represent the interests of state capital.

China has been slowly reforming its state sector in the past few decades and has established the State-owned Assets Supervision and Administration Commission (SASAC) to supervise more than 100 state firms.

Top management at SOEs are appointed by the CPC. Some executives go on to assume government posts after finishing their tenure at state companies.

The CPC is also improving its system for official assessment and promotion as part of a reform package to be implemented inside the party.

Official selection and promotion will be more merit-based and break away from such undue consideration such as seniority and GDP numbers, they said when the reform was passed at the recent bi-monthly legislature.

It has also vowed to step up oversight and crack down on officials holding side jobs such as board members or senior executives at state-owned firms or listed companies without approvals from the party.

Models with two-dimensional codes painted on bodies

Models with two-dimensional codes painted on bodies Antique exhibition of Maritime Silk Road held in Jinan

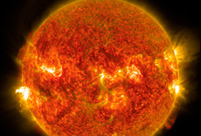

Antique exhibition of Maritime Silk Road held in Jinan NASA releases images of solar flare

NASA releases images of solar flare Daming Palace in Chang’an City in photos

Daming Palace in Chang’an City in photos Babies of celebrities born in the year of horse

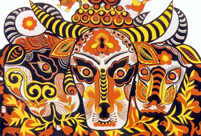

Babies of celebrities born in the year of horse Farmer Painting, one of Ansai's Three Strange Wonders

Farmer Painting, one of Ansai's Three Strange Wonders Special holidays

Special holidays World's top 10 fighters

World's top 10 fighters 'Stewardesses' serve in hospital

'Stewardesses' serve in hospital Capital Spirits: the capital's first liquor bar

Capital Spirits: the capital's first liquor bar 2014 int’l drone exhibition

2014 int’l drone exhibition Chengdu International Auto Show

Chengdu International Auto Show Trainings taken by Chinese navy divers

Trainings taken by Chinese navy divers Anti-terrorism electric patrol car

Anti-terrorism electric patrol car Female PLA honor guards

Female PLA honor guardsDay|Week|Month