|

| Customers pack store to buy gold in Beijing. (Photo/Xinhua) |

China's gold demand jumped to a record high in the first quarter despite a global drop of 13 percent, according to a report released by the World Gold Council on Thursday.

Gold jewelry demand in China surged to a record quarterly value of 60.3 billion yuan ($9.8 billion), the council said.

Traditional Spring Festival-related gold buying and gifting was augmented by a rebound in sentiment regarding the strength of the domestic economy.

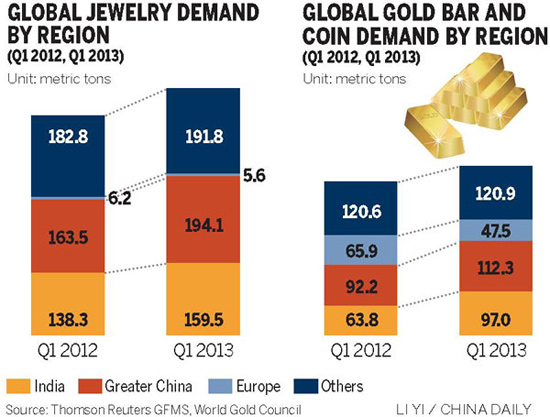

China and India accounted for a combined 62 percent of global jewelry demand in the first quarter.

China posted a new record for quarterly investment in gold bars and coins as positive seasonal factors worked in tandem with gold's enduring investment appeal. Demand grew to 109.5 metric tons, compared with a five-year quarterly average of 43.8 tons.

The Spring Festival period fueled buying in January, but demand was supported throughout the rest of the quarter as Chinese investors, discouraged by the weak domestic stock market, increasingly relied on gold to fulfill their investment needs.

The announcement in February of impending controls to be placed on the property market placed further emphasis on gold as an investment option.

Retail investors in China, India and the United States were at the forefront of investment demand in the first quarter, as evidenced by the strong rise in demand for gold bars and coins in those markets.

Global gold demand in the first quarter totaled 963 tons, decreasing 13 percent year-on-year as strong growth in consumer demand for gold jewelry, bars and coins was exceeded by substantial net outflows from gold exchange-traded funds.

"ETF data in the first quarter cannot reflect the true trading because gold can be borrowed," Hong Hao, managing director and chief strategist at BOCOM International Holdings Co Ltd told.

![]()