|

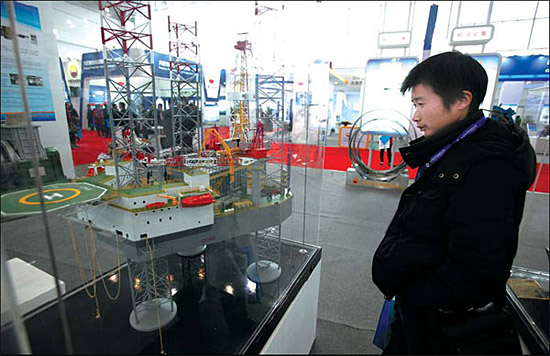

| A visitor at the China International Petroleum and Petrochemical Technology and Equipment Exhibition, which opened in Beijing on Tuesday. About 1,500 companies from 62 countries and regions are displaying their technologies and equipment at the show. Wang Jing / China Daily |

China's shale gas development will bring business opportunities to the related equipment manufacturing industry with a market value of about 3 billion yuan ($477 million) this year, a 33 percent growth compared with last year, industrial insiders said.

The second round of tenders for China's shale gas blocks was held last year, leading to increasing demand for fracturing equipment in the second half of this year, said Zhang Guoyou, general manager of the domestic sales department of SJ Petroleum Machinery Co under State-owned Sinopec Group, the country's largest oil and gas refiner.

According to China's 12th Five-Year Plan (2011-15) on energy industry, the country will realize large-scale commercialized production of shale gas by 2015.

To meet the target of 6.5 million cubic meters of production capacity by 2015, China is accelerating its pace in surveying and exploring the unconventional energy source. Experts said the main obstacle is the technology barrier during exploration.

However, equipment manufacturing companies have achieved some progress.

Zhang said the company will invest 1.1 billion yuan on research for shale gas exploration equipment during the 12th Five-Year Plan.

The company has sold 20 fracturing equipment units, and four units were ordered and will be delivered over the next two months, Zhang said.

Fracturing equipment is the core machine for shale gas exploration, accounting for more than 65 percent of all equipment needed for its production.

Having more shale gas reserves than the United States, China has created a huge market for the related equipment manufacturing industry, said Jiang Xiaobao, vice-president of Yantai Jereh Oilfield Services Group Co, a private oil and gas services company, which owns about half of the domestic shale gas equipment market share.

The US has an annual demand for fracturing equipment of about 800 units for the shale gas industry, which means China will have a similar demand if it wants to develop to the same scale as the US, Jiang said.

China bought 200 units of fracturing equipment in 2012, twice the amount in 2011. Demand will definitely soar this year, Jiang said.

"China has very different shale exploration conditions compared with the US, which requires that the equipment can be operated in mountain areas with a bad geological environment," Jiang said. "We are developing such equipment that fits China."

China's shale gas development plan has also attracted foreign equipment manufacturing companies besides oil and gas developer Royal Dutch Shell Plc, which has cooperated with Chinese companies for upstream exploration.

Caterpillar Inc, the world's biggest heavy machinery maker, has developed a new type of engine used for fracturing equipment in China's shale gas blocks, said Felix Toh, regional manager of sales and marketing department of Caterpillar's Global Petroleum Asia Pacific.

"We are trying to get closer to our customers," he said.

Although China's shale gas market is attractive to both foreign and domestic investors, many industrial experts said there is still a long way to go before the industry becomes mature.

"It is a trend to invest in and develop equipment for shale gas exploration among manufacturing companies, but the potential of the market depends on major exploration companies - Sinopec and PetroChina Co's technology development in the following years," said Xiao Shaosong, vice-president of Shengli Oilfield Highland Petroleum Equipment Co, China's biggest private incorporated comprehensive petroleum equipment provider by market value.

It realized total profits of 20 million yuan in 2012, and 40 percent of its products were exported.

Seeking a dream wedding at Beijing Wedding Expo

Seeking a dream wedding at Beijing Wedding Expo

![]()