China's consumer healthcare market features lower entry barriers, but can see larger variances in quality and improper sales practices as a result.

Bruce Liu said that all multinationals are having to get used to China's idiosyncrasies, but that their expertise in health products is a particular strong selling point.

One of the biggest differences being felt by multinationals, is in marketing.

Selling consumer healthcare products can be highly different to selling pharmaceutical products, especially in retail chains.

In recent years, retail pharmacies have become an increasingly important channel for the sale of consumer healthcare products and now represent 25 percent of sales.

Direct sales and modern trade channels such as hypermarkets, supermarkets and convenience stores are playing a bigger role.

To cover these new channels, drugmakers are having to invest more in branding, promotion and advertising, above and below the line, say experts.

"Many think the consumer healthcare sector provides fat profits. However, when we take marketing and advertising activities into account, profits in China are not as high as consumers think," said Liu Zhanglin.

That's maybe the reason that Pfizer has always said that to expand market share and consolidate its presence in China, to launch any new product, it has to be prepared to lose money for at least three years.

Liu said domestic and foreign players have to clearly identify their target groups.

Older Chinese people remain the typical buyers of TCM-related products, and TV and newspaper advertising remain powerful promotional tools.

For young and middle-aged people, interest in foreign-made supplements is growing, and e-commerce and supermarkets are proving the most effective channels.

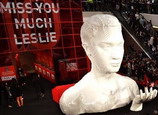

Exhibition marks 10th anniversary of Leslie Cheung's death

Exhibition marks 10th anniversary of Leslie Cheung's death

![]()