Experts say the Chinese consumer healthcare market is far from fragmented, but there are already a large number of brands competing in many categories, such as traditional Chinese medicine, Western-styled supplements and natural herbs.

There are more than 20 Chinese and multinational brands attracting sales of more than $100 million in China, according to a recent report by McKinsey & Co.

Those include "Daktarin", a medicine which is used in certain types of fungal infections, sold by Xian-Janssen Pharmaceutical Ltd, Pfizer's Caltrate, "Sidashu", a gastric medicine combing Chinese and western tecnniques produced by China's Xiuzheng Pharmaceutical Group, and Sanjiu Medical & Pharmaceutical Co Ltd's famous "999" branded products.

Liu Zhanglin highlights the success, in particular of traditional Chinese medicine company Beijing Tongrentang Group, which said last month it will open another 100 self-operated pharmacies around China and 10 stores overseas this year.

The maker of traditional Chinese medicine has more than 1,500 self-operated pharmacies in China and more than 70 in overseas markets, including the United States, the United Kingdom, Australia, Singapore and Hong Kong.

Its products include TCMs, consumer healthcare products and health food and medical cosmetics.

Half of its profit is contributed by its consumer healthcare business, which covers herbal supplements, TCM nourishment and diet products, and cosmetics. The Chinese medical company's 2012 profit is estimated at 562 million yuan.

However, Liu points out that some Chinese products still tend to be sold using overly extravagant advertising and packaging.

"The high prices of some Chinese goods also scare some consumers, while Western products are, in general, priced reasonably," said Liu.

Chinese companies are good at TCM-related products, while multinational companies are the masters of Western-styled supplements, but both presenting different challenges, he added.

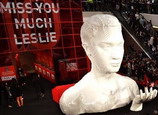

Exhibition marks 10th anniversary of Leslie Cheung's death

Exhibition marks 10th anniversary of Leslie Cheung's death

![]()