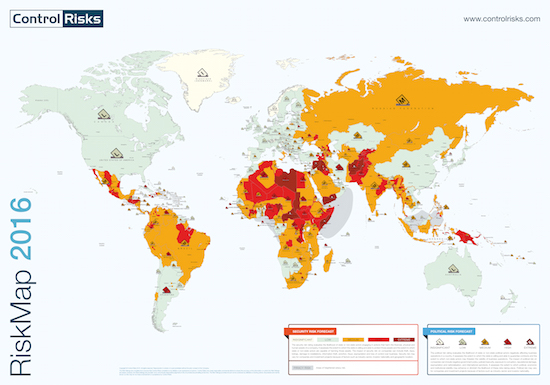

The 2016 RiskMap.Graphic: CONTROL RISKS

A stagnating economy, persistent high levels of crime, increasing protests, regulatory uncertainty and cyber vulnerabilities are the key risks faced by South African businesses in the year ahead. Regionally, depressed commodity prices and how countries deal with this economic downturn will define the risk landscape for Southern African Development Community (SADC) in the upcoming year.

These are some of the key messages of RiskMap 2016, published earlier this month by global business risk consultancy Control Risks. RiskMap highlights the most significant underlying trends in global risk and security, and provides a detailed view from the markets that will matter most in 2016.

Drawing on expertise from its worldwide network, the annual Risk Map ranks global countries in three areas: political risk, security risk and economic risk, colouring them in light yellow, green, orange or dark red accordingly. On this year’s map — and even since a few years ago — most of the African continent is seen in red and orange areas, which implies high risks of operating a business in these areas.

Despite security risks in Johannesburg and political risk in Lesotho, southern Africa is experiencing lower risk relatively, while East Africa and North Africa are suffering from hot water, as pointed out by Steven Kuo, an analyst at Control Risks, when it launched the Risk Map in Johannesburg to Chinese enterprises in SA.

“As we see growing Chinese investment in SA or in the whole continent, they are encountering various unexpected obstacles on the unfamiliar land. We feel it is necessary to build up the connection with Chinese enterprises here and to create a guide for navigating challenges and opportunities in the year ahead,” says

Chris Torrens, Senior MD of Control Risks, when he explained the initiative at the special launch.

RongYansong, Chinese Economic and Commercial Counsellor to SA, is direct about it: “Compared to multinational giants from the Western countries, Chinese enterprises are still lacking experience in operating business abroad — even though they have grown rapidly in recent years they are still vulnerable.

“The Chinese government

pays great attention to these circumstances and has set a series of guides and regulations. But regarding feedback from enterprises in the forefront of growing businesses, tailor-made services are in demand.”

According to RiskMap 2016, the stagnating economy in SA drives rising crime, while trade unions are likely to respond to higher inflation by becoming more militant and inflexible during wage negotiations. Social unrest, previously largely restricted to low-income areas on the outskirts of the cities, is increasingly becoming a consideration in major business districts. Large-scale marches and demonstrations in response to specific political issues increased in the latter part of 2015 and will continue to escalate in 2016 as political parties prepare for the local government elections. This will probably prevent any rapid and substantial improvement and, as a result, SA’s economy will remain vulnerable.

George Nicholls, Senior MD of Control Risks, says that one of the largest risks is that South Africans are losing perspective.

“Positive developments get overlooked and drowned out by the cacophony of negative sentiment. Business and government get sidetracked by emergencies, and the casualty is the ability to consider the medium to long-term outlook.”

He says that there is much to be positive about SA — a robust judiciary, vibrant independent media, value in commodity stocks and a gateway to the Africa Rising story.

“Renewables are a booming sector and the weak rand makes South African exports competitive,” he concludes.

(The story was originally published on Business Day on March 31st, 2016.)

Train rides through blossoms

Train rides through blossoms HD pictures of battleships of PLA Navy

HD pictures of battleships of PLA Navy East Sea Fleet conducts combat drills

East Sea Fleet conducts combat drills Sophie Marceau goes square dancing in Guangzhou

Sophie Marceau goes square dancing in Guangzhou Police officers learn Wing Chun in E. China

Police officers learn Wing Chun in E. China Charming models compete in super model contest in Beijing

Charming models compete in super model contest in Beijing Thai most beautiful transgender Nong Poy release new photos

Thai most beautiful transgender Nong Poy release new photos Now and then photos of Shanghai Jiaotong University

Now and then photos of Shanghai Jiaotong University Is this what air travel will look like in 2050?

Is this what air travel will look like in 2050? Top 20 hottest women in the world in 2014

Top 20 hottest women in the world in 2014 Top 10 hardest languages to learn

Top 10 hardest languages to learn 10 Chinese female stars with most beautiful faces

10 Chinese female stars with most beautiful faces China’s Top 10 Unique Bridges, Highways and Roads

China’s Top 10 Unique Bridges, Highways and Roads Vaccine scandal injects worry, anger

Vaccine scandal injects worry, anger  Zhiqingband together to care for each other

Zhiqingband together to care for each other China’s live broadcasting gravy train

China’s live broadcasting gravy train Steady diplomacy expected from Myanmar's new government

Steady diplomacy expected from Myanmar's new government Day|Week