Video snapshots

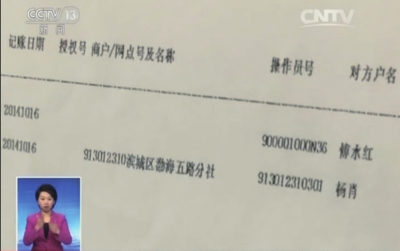

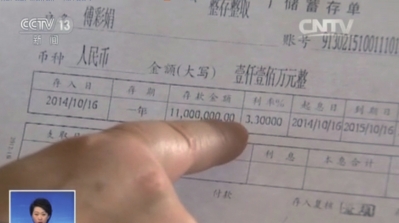

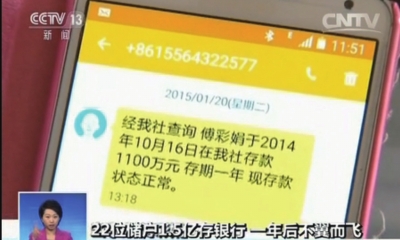

With no text or phone call reminder, 22 clients’ deposits totaling 150 million yuan at a bank was suddenly gone, and the clients were told that the deposit slips they held were fake.

From May to November of this year, five people from Shaoxing, Zhejiang Province were told that their deposit slips were fake when they tried to make withdrawals at a bank in Shandong Province. There was no record of making the initial deposit, either. The deposits of these five Shaoxing clients were 8 million yuan, 6.7 million yuan, 2.26 million yuan, 5 million yuan and 1.27 million yuan, respectively. Besides these five clients in Shaoxing, there are 17 other people from different places in Zhejiang who also lost their deposits in the bank in Shandong.

Why would these people put money in a non-local bank? It is known as “extra-interest deposit”—besides regular interest from the bank, there is extra interest from lending companies with high interest rates. As a matter of fact, “extra-interest deposit” had been officially forbidden by the China Banking Regulatory Commission, the Ministry of Finance of China, as well as People’s Bank of China, yet there are still bank clients, banks, and companies secretly doing the business. The greater the amount of the deposit, the higher the interest rate. In this case, the interest of the bank in Shandong was much higher than the one in Zhejiang, which is why these five people got taken in by the scam.

This case is currently under investigation by the Shandong police department. Two bank employees have been arrested for forging financial bills.

All-star Carnival held in Beijing

All-star Carnival held in Beijing Charming female bodybuilders of Chengdu University

Charming female bodybuilders of Chengdu University Polish sports stars strip off for risqué calendar

Polish sports stars strip off for risqué calendar Spectacular aerial photos of the Three Gorges

Spectacular aerial photos of the Three Gorges Contestants of Mrs. Globe pose for photo in Shenzhen

Contestants of Mrs. Globe pose for photo in Shenzhen

Bikini models attend hot pot banquet in Hefei

Bikini models attend hot pot banquet in Hefei J-10B fighters with homegrown engine in test fligh

J-10B fighters with homegrown engine in test fligh Photos of U.S. Navy intruding in South China Sea released

Photos of U.S. Navy intruding in South China Sea released Cats who immediately regretted their life choices in photographs

Cats who immediately regretted their life choices in photographs Top 20 hottest women in the world in 2014

Top 20 hottest women in the world in 2014 Top 10 hardest languages to learn

Top 10 hardest languages to learn 10 Chinese female stars with most beautiful faces

10 Chinese female stars with most beautiful faces China’s Top 10 Unique Bridges, Highways and Roads

China’s Top 10 Unique Bridges, Highways and RoadsDay|Week