|

| 11379856555104056307 |

The latest round of state-owned enterprise reform measures, announced on Sunday, are a fresh signal of China's commitment to structural transformation.

The package of reforms released on the weekend aim to separate direct administrative interference from market operations, while improving efficiency and countering downward pressure on growth.

China has about 150,000 state-owned enterprises, which hold over 100 trillion yuan (15.7 trillion US dollars) in assets and employ more than 30 million people. Thus, any reform to the sector will have a significant effect on the economy as a whole.

"Our company has been listed on the stock market. Yet we still receive many government orders that ask us to follow certain guidelines. Some of the directives can not be practiced in market competition," said a major state-owned enterprise chief executive, who requested anonymity.

The reform package aims to tackle problems such as low efficiency and unclear management structure in some state-owned enterprises.

Analysts say the economy can significantly benefit from the reform package as state-owned enterprises will generate more profits because of improved efficiency. A management rejig will make enterprises more efficient.

Companies that invest and operate state capital will be created, and state-owned enterprises will be largely regulated through the management of capital instead of the management of companies themselves.

State-assets regulators will offer guidance to SOEs via government-backed capital investment and operation platforms, thus, avoiding direct government intervention, according to Xu Hongcai, assistant minister of finance.

In Shanghai, state capital operation measures have been tested since last year.

"The companies that invest and operate state capital have no authority in administrative regulation. They can only use market tools rather than administrative orders. The reform measure will help the market play a decisive role in allocating resources," said Chen Qingtai, former president of China Association for Public Companies.

The State-owned Assets Supervision and Administration Commission said it would not involve itself in market operations that fall out of its authority.

According to the reform package, state-owned enterprises will be categorized in two groups, commerce or public interest.

"For state-owned companies that are supposed to provide public products and services, regulators should not evaluate them on how much money they make but on the quality of what they provide to the public," said Gao Minghua, director of Beijing Normal University research institute of corporate management and development.

Art photos of Chinese beauty in Han Chinese clothing

Art photos of Chinese beauty in Han Chinese clothing Stunning photos of air show in China’s V-Day parade

Stunning photos of air show in China’s V-Day parade Construction of HK-Zhuhai-Macao Bridge enters final stage

Construction of HK-Zhuhai-Macao Bridge enters final stage Models change clothes on street in Hangzhou

Models change clothes on street in Hangzhou Model of heavy-lift copter makes debuts at Tianjin expo

Model of heavy-lift copter makes debuts at Tianjin expo Charming Chinese female soldiers

Charming Chinese female soldiers Beauty vs. muscular man

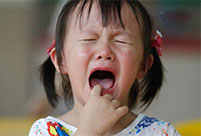

Beauty vs. muscular man First day in kindergarten

First day in kindergarten Pilots attending V-Day parade take group photos with their planes

Pilots attending V-Day parade take group photos with their planes Market plunges despite SOE plans

Market plunges despite SOE plans Refugee crisis spreads Syria woe to Europe

Refugee crisis spreads Syria woe to Europe China agrees to share advancements in satellites, telecom with Arab states

China agrees to share advancements in satellites, telecom with Arab states Chinese overseas investment hindered by lack of experience, political opposition in host countries

Chinese overseas investment hindered by lack of experience, political opposition in host countriesDay|Week