|

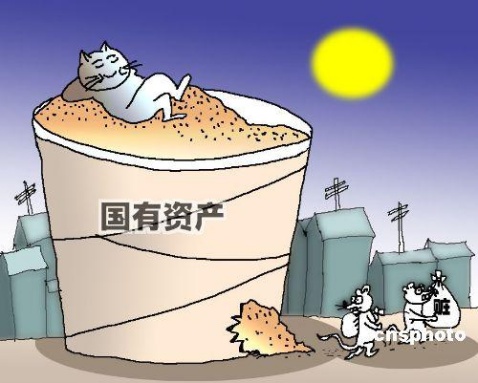

BEIJING, Sept. 14 -- Mixed-ownership reforms for state-owned enterprises (SOEs) should keep in mind the benefits involved with multiple investors and work to prevent the loss of state-owned assets, a senior official said on Monday.

Mixed-ownership reforms for SOEs should be government-led and market-based with an emphasis on improving the management of state assets, said Lian Weiliang, deputy head of the National Development and Reform Commission (NDRC).

China's central authorities issued a new guideline on SOE reforms on Sunday as the government seeks to invigorate torpid SOEs.

The guideline encourages diversified ownership structures through "mixed ownership", or the introduction of "multiple types of investors".

Non-state firms will be encouraged to join the process by buying stakes and convertible bonds from or conducting share rights swaps with SOEs, among other measures, according to the guideline.

The mixed-ownership reform will promote new technology, management and business models for SOEs, Lian told a press conference held by the State Council.

In 2015, China will pilot a program that will allow more than 110 state-owned conglomerates administered by the State-owned Assets Supervision and Administration Commission (SASAC) to invest assets and help create and operate companies, said Xu Hongcai, assistant finance minister, at the press conference.

The pilot program will be market-oriented and intervention by government agencies will be forbidden, said Xu.

Mixed-ownership reforms for SOEs are a significant part of China's economic restructuring. The SASAC has rolled out a series of measures to hasten the process.

Giant SOEs such as China National Petroleum Co. and China Telecom have carried out their own plans to diversify corporate ownership and invited cooperation with social funds.

Models change clothes on street in Hangzhou

Models change clothes on street in Hangzhou Charming iron ladies in China's upcoming V-Day celebrations

Charming iron ladies in China's upcoming V-Day celebrations In pics: armaments displyed in massive military parade

In pics: armaments displyed in massive military parade Charming Chinese female soldiers

Charming Chinese female soldiers Volunteers required not taller than 5ft 5in

Volunteers required not taller than 5ft 5in  Czech pole dancing master teaches in Xi'an

Czech pole dancing master teaches in Xi'an Shocked! PLA smokescreen vehicle drill

Shocked! PLA smokescreen vehicle drill Foreigners experience tranditional Chinese wedding

Foreigners experience tranditional Chinese wedding Blind date with bikini girls in Nanjing

Blind date with bikini girls in Nanjing Living heritage

Living heritage More SOE reforms on the way

More SOE reforms on the way NYT shifts refugee crisis attention to China

NYT shifts refugee crisis attention to China Govt cracks down on editors accepting bribes to delete negative online reports

Govt cracks down on editors accepting bribes to delete negative online reportsDay|Week