Xinhua News Agency: Since the beginning of last year, the banks' NPL ratio has been increasing and cases of financial risks of shadow banking have occurred from time to time. Soon many local governments will see their debt come due. As the downward pressure on China's economy grows, how do you see the growing financial risks?

Li Keqiang: I see financial risks are the focus of your questions. It's true that there have been individual cases of financial risks in China, but we are fully capable of forestalling systemic and regional financial risks. China's economy continues to operate within the proper range and there is a fairly high savings rate in China. Moreover, 70% of local government debts are in the form of investment which boasts quite good prospect for yielding returns. We are also regulating the local government financing vehicles to ensure that we will keep front doors open and block back doors. Chinese banks have a fairly high capital adequacy ratio and ample provisions. It's true that there are non-performing loans and the NPL ratio has risen somewhat. Still, the level is quite low internationally.

Let me make clear here: Individual cases of financial risks will be allowed. We encourage the practice of balancing one's book in a market-based way to guard against moral hazard and raise people's awareness of financial risks. This year, we will set up the deposit insurance system and continue to develop multi-tiered capital markets to lower corporate leverage ratio. All these efforts will help ensure that financial services can better serve the real economy.

|

Day|Week

Tsinghua junior makes over 10,000 yuan a day by selling alumnae's used quilts

Tsinghua junior makes over 10,000 yuan a day by selling alumnae's used quilts Graduation photos of students from Zhongnan University

Graduation photos of students from Zhongnan University A school with only one teacher in deep mountains

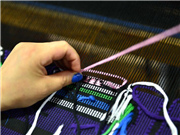

A school with only one teacher in deep mountains Glimpse of cultural heritage "Xilankapu"

Glimpse of cultural heritage "Xilankapu" Homemade cured hams in SW China

Homemade cured hams in SW China Breathtaking buildings of W. Sichuan Plateau

Breathtaking buildings of W. Sichuan Plateau Graduation photos of "legal beauties"

Graduation photos of "legal beauties" Top 10 most expensive restaurants in Beijing in 2015

Top 10 most expensive restaurants in Beijing in 2015