TORONTO, March 23 -- ICBC Canada, a renminbi clearing bank, was officially launched here on Monday, becoming the first RMB trading hub in the Western hemisphere.

Canadian Finance Minister Joe Oliver and Chinese ambassador to Canada Luo Zhaohui inaugurated the trading hub also known as ICBK.

"Today's announcement of the launching of a renminbi hub reinforces the strength of our ties," Oliver told the launching ceremony.

"Through lower transaction costs, it is now easier for Canadian firms to trade with and do business in China. This will mean jobs, growth, and long-term prosperity for Canadians, and a brighter future for both our great countries," said the finance minister.

The hub is the latest step to boost Canada-China trade now worth 78 billion Canadian dollars (62.21 billion U.S. dollars). Currently, Canadian companies buying and selling in China have to use an intermediary currency, usually the U.S. dollar, an extra step that adds costs and a layer of complexity.

At the ceremony, ICBC Vice President Gu Shu said that the bank would fully utilize Canada's geographic and multiple time-zone advantages in support of the bank's 24/7 RMB clearing system.

The ICBK will take over RMB clearing services when transactions in Beijing and Singapore are closed, said Gu.

The ICBK has established two RMB clearing teams respectively in Toronto and Vancouver, between which there is a three-hour time difference, so that the Vancouver center can extend operations for three hours after the Toronto market is closed.

Toronto and Vancouver had been rivals for the designation. The split of the center makes both regions -- British Columbia and Ontario -- happy.

"This is important, in terms of improving our competitiveness for Toronto, for Ontario, for Canada," Ontario Finance Minister Charles Sousa said at the launch.

"Using Toronto as the platform, as the go-between, is critical -- not only to our brand, but it also speaks to the prominence of our financial sector here in Canada," Sousa said.

British Columbia Finance Minister Michael de Jong said: "Having a Canadian renminbi hub will enable British Columbia businesses to take advantage of the benefits that flow from doing RMB-denominated transactions. This is an exciting opportunity for British Columbia and we are dedicated to ensuring the success of this pan-Canadian initiative."

China had already designated other cities around the globe, including Singapore, London, Frankfurt and Seoul, as offshore trading hubs. The Canadian hub is likely to attract business from Central and South America, as well as the United States and Canada, analysts predicted.

"China is Canada's second-largest trading partner. The establishment of the RMB offshore center will make it easier for Canadian businesses to settle in RMB and, as a result, we can expect growing trading volumes in RMB-denominated assets," Domenico Lombardi, a leading researcher from Canadian think tank CIGI, told Xinhua.

|  |

Day|Week

Tsinghua junior makes over 10,000 yuan a day by selling alumnae's used quilts

Tsinghua junior makes over 10,000 yuan a day by selling alumnae's used quilts Graduation photos of students from Zhongnan University

Graduation photos of students from Zhongnan University A school with only one teacher in deep mountains

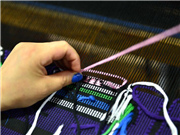

A school with only one teacher in deep mountains Glimpse of cultural heritage "Xilankapu"

Glimpse of cultural heritage "Xilankapu" Homemade cured hams in SW China

Homemade cured hams in SW China Breathtaking buildings of W. Sichuan Plateau

Breathtaking buildings of W. Sichuan Plateau Graduation photos of "legal beauties"

Graduation photos of "legal beauties" Top 10 most expensive restaurants in Beijing in 2015

Top 10 most expensive restaurants in Beijing in 2015