At least 70 Chinese-listed companies have been affected by China's ongoing anti-graft campaign, with companies from the energy and natural resources sectors taking the biggest hit, media reports revealed Monday.

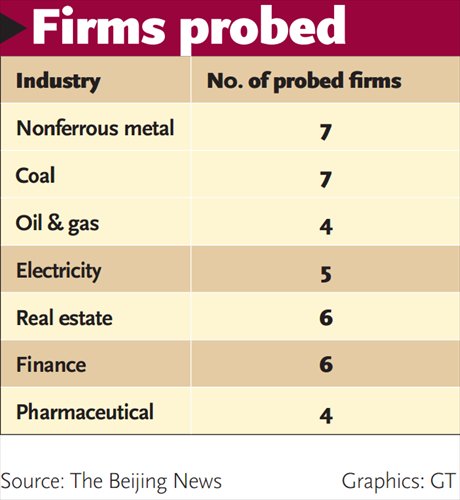

According to The Beijing News, 18 companies from the energy and natural resources sectors, including nonferrous metal, coal, oil and gas industries have been tainted by corruption scandals, roughly one-quarter of the total number.

Six of the affected companies are in real estate and six from finance sectors. The newspaper also tallied four pharmaceutical firms and three from the shipping industry.

Companies listed include both State-owned enterprises and private firms.

The report came after a slew of executives, including China Minsheng Banking Corp president Mao Xiaofeng and CEO Li You of the Founder Group, a high-tech conglomerate, were reportedly recently taken away for investigation.

"Many of the companies suffered severe consequences from the anti-graft campaign, such as profit slumps and executives resigning. Some companies even filed for bankruptcy. But in the long-term, anti-graft measures are beneficial to the market as it regulates the behavior of both the companies and the officials. It's making our business practice healthier and more transparent," Lin Boqiang, a professor with Xiamen University, told the Global Times.

Others feel that excessive government intervention is one reason behind the corruption.

"[Take the real estate sector for example,] government is both the supplier of land and the regulator of the real estate market. The system is prone to corruption as officials and entrepreneurs can easily collude with each other to maximize their benefits," said Gu Yunchang, a secretary-general of the China Real Estate Association, according to The Beijing News.

The Central Commission for Discipline Inspection (CCDI) of the Communist Party of China (CPC) last week released the result of its third round of inspections in 2014. It reported that some executives in China Unicom, a State-owned telecommunication company, have traded their power for money and sex, allowed relatives and relevant people to seek profits under their influence as well as receive perks and foreign trip packages from suppliers.

The CCDI also reported on problems it found with energy giants Shenhua Group and China Huadian Corporation, and China State Shipbuilding Corporation.

"This round of inspections is different from the previous ones … the CCDI is known for its careful choice of targets. This round focused on large SOEs and revealed quite a few problems. It could be a signal that the CCDI is shifting its focus to large SOEs this year," read a commentary by the Beijing Youth Daily.

Although the companies involved in the graft scandals come from different industries and suffered various degrees of punishment, investigations showed a resemblance in methods as companies tried to cozy up to officials to obtain approval for land, mining or other proprietary rights.

Liu Tienan, former deputy chief of the National Development and Reform Commission, was sentenced to life imprisonment in December for trading his power at the national economic planning body for benefits from companies.

He used his influence to help businessman Song Zuowen, board director for the Nanshan Group, acquire a contract with the Aluminum Corporation of China in exchange for 7.5 million yuan ($1.2 million).

Some offered jobs for relatives or mistresses of high-level officials in exchange for favors and leverage in businesses.

Minsheng Bank allegedly paid salaries to a dozen relatives of high-level officials who did not carry out any actual work.

People in this "secret club" included former senior official Ling Jihua's wife Gu Liping, and Yu Lifang, wife of Su Rong, former vice chairman of the Chinese People's Political Consultative Conference's National Committee, according to caixin.com. Ling Jihua, former leader of the United Front Work Department of the CPC Central Committee, is currently under investigation for violating Party discipline.

Some officials adopt a more clandestine method to make money. Their relatives would help small companies acquire initial public offering approvals with their family's political influence and gain huge profits selling company shares.

Ling Jihua's brother, Ling Wancheng, who also used the name Wang Cheng, became incredibly rich by running several companies that went public from 2008 to 2010, reported The Beijing News.

Shares of the firms liked to Ling, including LeTV, one of China's leading online entertainment portals, fell after announcement of the CCDI probe into Ling in December as investors rushed to cash out amid fears of a further slump.

PLA soldiers operating vehicle-mounted guns in drill

PLA soldiers operating vehicle-mounted guns in drill Beauties dancing on the rings

Beauties dancing on the rings Blind carpenter in E China's Jiangxi

Blind carpenter in E China's Jiangxi Top 10 highest-paid sports teams in the world

Top 10 highest-paid sports teams in the world In photos: China's WZ-10 armed helicopters

In photos: China's WZ-10 armed helicopters UFO spotted in several places in China

UFO spotted in several places in China Certificates of land title of Qing Dynasty and Republic of China

Certificates of land title of Qing Dynasty and Republic of China  Cute young Taoist priest in Beijing

Cute young Taoist priest in Beijing New film brings Doraemon's life story to China in 3D

New film brings Doraemon's life story to China in 3D China-S.Korea FTA sets positive precedent

China-S.Korea FTA sets positive precedent Ferry carrying 458 people sinks in Yangtze River

Ferry carrying 458 people sinks in Yangtze River Mecca of Marxism

Mecca of Marxism Bring them home

Bring them homeDay|Week