Air Forces arrive at designated area to join China-Russia drill

Air Forces arrive at designated area to join China-Russia drill

Jumping into sea: People celebrate National Fitness Day

Jumping into sea: People celebrate National Fitness Day

Old town Dali hosts int'l photography exhibition

Old town Dali hosts int'l photography exhibition

A brighter future for Sino-Russian relations

A brighter future for Sino-Russian relations

China has a new 'tallest building'

China has a new 'tallest building'

Sexy models in CFGP race

Sexy models in CFGP race

China Coast Guard patrols Diaoyu in‘longest stay’

China Coast Guard patrols Diaoyu in‘longest stay’

Study reaffirms 'cancer villages'

Study reaffirms 'cancer villages'

Opening ceremony of Women's World 9-Ball Championship

Opening ceremony of Women's World 9-Ball Championship

|

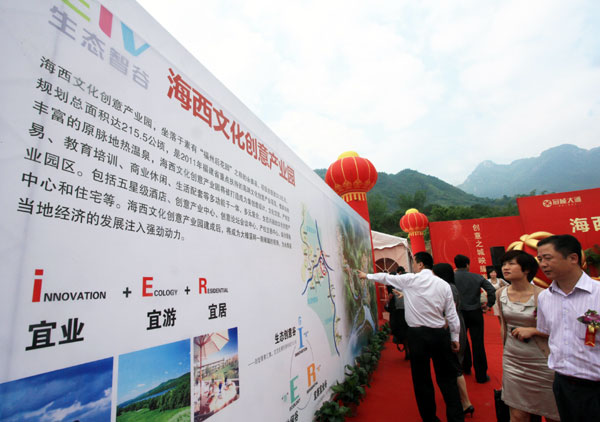

| Visitors are showed the Haixi Culture Creative Industrial Park in Fuzhou, Fujian province, developed by the Citychamp Dartong Co Ltd in 2011. The company plans to issue 1.8 billion yuan in convertible bonds to finance a commercial property project in Nanjing. [Photo / China Daily] |

Two small property developers announced plans on Wednesday to fund new projects through bond and share issues, sparking market talk that the moratorium of more than three years on property developers' financing may be loosened.

In a filing with the Shanghai Stock Exchange, Hangzhou-based Sundy Land Investment Co Ltd said that it is awaiting approval by the China Securities Regulatory Committee for a private placement of up to 1.5 billion yuan ($245 million) in shares.

The proceeds will be used for residential projects in Nanjing, Jiangsu province and Hangzhou, Zhejiang province.

Also, Fuzhou-based Citychamp Dartong Co Ltd said it plans to issue 1.8 billion yuan in convertible bonds to finance a commercial property project in Nanjing.

Last Friday, Shanghai-listed Xinhu Zhongbao Co Ltd said in a statement to the bourse that it would place 5.5 billion yuan in shares with less than 10 investors to finance urban renovation work in Shanghai.

These plans add weight to the belief that the government may ease restrictions on developers' financing activities on the A-share market.

"The ban is being lifted and many cash-starved developers will benefit," said Hui Jianqiang, director of real estate information provider Beijing Zhongfangyanxie Technology Service Ltd.

As part of the nation's drive to cool the property market, the CSRC halted refinancing by listed property developers starting in the second quarter of 2010.

China Merchants Property Development Co Ltd unveiled a plan on Tuesday to issue additional shares to buy assets.

Its shares were suspended from trading starting on Wednesday, pending further announcements.

Lu Qilin, research director at Shanghai Deovolente Realty, remained cautious about the possible end of the refinancing ban, stressing that regulators will pay close attention to how any such funds raised are actually used.

"There are more than 10,000 property developers nationwide, but only 143 are listed, which means [new refinancing activity] will only benefit a small portion of real estate companies, leading to unfair competition," said an analyst who asked to remain anonymous.

Song Huiyong, director of the research and consulting department at property consultancy Shanghai Centaline, said every refinancing plan should be accompanied by a clear explanation of how the money will be used.

"Xinhu Zhongbao will use the money to renovate slums, Sundy Land will use 80 percent of the raised capital to develop small and medium-sized residential properties and Citychamp Dartong will use the money on commercial property," said Song.

According to analysts, the costs of A-share refinancing, regardless of whether it's debt or equity, are much lower than other available sources of funds, which now cost about 8 to 10 percent.

"If direct refinancing becomes permissible, more plans will be unveiled by developers," said Lu.

There has been no successful listing on the A-share market for domestic developers since Wuhan Langold Real Estate Co Ltd went public in November 2009 in Shenzhen.

Chinese troops of "Peace Mission - 2013" arrive at exercise area

Chinese troops of "Peace Mission - 2013" arrive at exercise area Pakistan's rain-triggered accidents claim 29 lives: media

Pakistan's rain-triggered accidents claim 29 lives: media More Chinese stores ban bear bile

More Chinese stores ban bear bile Top 10 most dangerous jobs in the world

Top 10 most dangerous jobs in the world Weekly Sports Photo: Beauty of Nine Ball; world's 'tallest' couple

Weekly Sports Photo: Beauty of Nine Ball; world's 'tallest' couple Models wear fur clothing in high temperature for ads

Models wear fur clothing in high temperature for ads Day|Week|Month