China has had a terrible past few weeks, but that won't stop its growing dominance in the world, said Time magazine in its latest edition published on August 20.

The article, titled “the China Decade,” was written by Ian Bremmer.

Stock market plunges, currency devaluations and warehouse fireballs out of China have dominated headlines this summer. But that doesn't stop China’s rise, says the article.

Although China’s economic growth is slowing, but still to levels enviable in any developed country, the article says.

In the meantime, China’s march to no. 1 continues. In 2014, China’s total GDP overtook the US’s when measured by purchasing power parity.

Using this metric, China accounted for 16.32 percent of world GDP in 2014, eclipsing the US’s 16.14 percent.

More impressive than the size of China’s economy is the speed with which it’s grown. Back in 2000, Chinese imports and exports accounted for 3 percent of all global goods traded.

By 2014, that figure had jumped to more than 10 percent. In 2006, the U.S. was a larger trade partner than China for 127 countries.

China was the larger partner for just 70. Today, those numbers have reversed: 124 countries trade more with China than with the United States, the article adds.

And despite recent turmoil, China’s economy has staying power. That’s in part because China’s leadership has spent decades building its foreign exchange reserves, which today are valued at $3.7 trillion. That’s by far the world’s biggest rainy day fund.

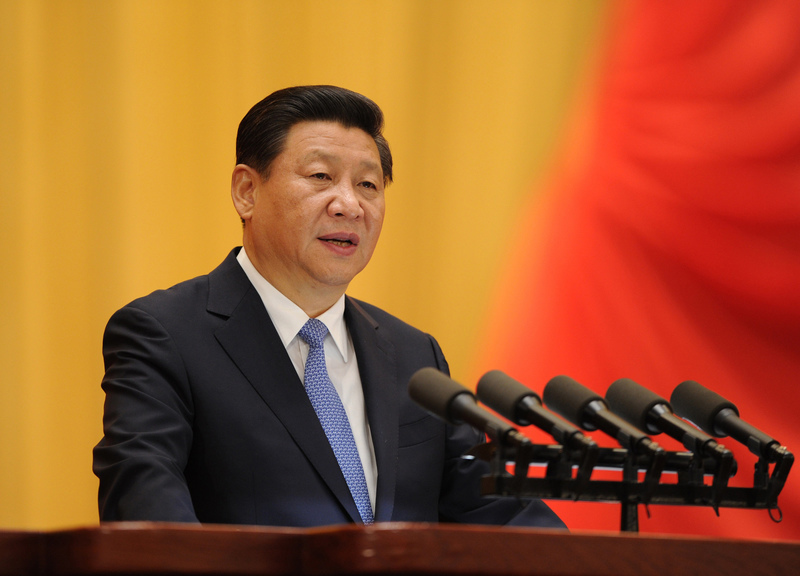

More important than its money buffer is China’s consolidated political leadership under Xi Jinping. China’s president has presided over an extensive anti-corruption campaign that has already seen 414,000 officials disciplined and another 200,000 indicted.

In the process, Xi has probably rebuilt some of the party’s lost credibility with China’s people.

He has definitely sidelined current and potential opponents of his reform program—and of his rule. And the lack of backlash illustrates just how strong his political control really is, Ian points out.

Consolidated leadership also enables Beijing to pursue its comprehensive global strategy.

China has spent the last two decades tactically investing around the world. Chinese investments in Africa jumped from $7 billion in 2008 to $26 billion in 2013, helping the continent build desperately-needed roads, rails and ports.

In Latin America, China has already pledged to invest $250 billion over the coming decade, giving Beijing a solid foothold in the West.

This extends China’s influence well beyond East Asia, helps China secure long-term supplies of the commodities it needs to continue to power its economy, create jobs for Chinese workers, and help China open new markets for its excess supplies of industrial products, Ian continues.

China also wants to use its money to reshape the world’s financial architecture.

To that end, Beijing just launched the Asian Infrastructure Investment Bank to rival the Washington-based IMF and World Bank.

Given that 57 countries have signed up as founding members, some of them US allies who chose to ignore US objections, it’s well on its way.

With initiatives like the AIIB, China will continue funding infrastructure projects—and building goodwill—for years to come, the article notes.

Yet, the article also mentions China’s longer-term challenges such as an aging labor force and pollution.

The article concludes that China’s growing strength threatens the established world order, but its domestic vulnerabilities will have global repercussions, as well.

It’s still too early to tell which of the two will be more destabilizing. Either way, the world will be shaped by Beijing’s successes and its failures, Ian emphasizes.

In pics: album of PLA grand military parades

In pics: album of PLA grand military parades Chinese tanks in National Day Parade

Chinese tanks in National Day Parade In pics: shocking aftermath of Tianjin blasts

In pics: shocking aftermath of Tianjin blasts

Indomitable Chinese people during WWII

Indomitable Chinese people during WWII

Awesome Chinese missiles

Awesome Chinese missiles Amazing photos of Chinese Air Force in parade

Amazing photos of Chinese Air Force in parade Striking moments when strategic missiles are launched

Striking moments when strategic missiles are launched Shocking scenes found in 4000-year-old earthquake relic

Shocking scenes found in 4000-year-old earthquake relic Stunning moments of Chinese fighter jets

Stunning moments of Chinese fighter jets Pulling on the river

Pulling on the river Korean tensions won’t take China hostage

Korean tensions won’t take China hostage Are we efficient enough?

Are we efficient enough? ‘Sensitive’ arms exhibited in parade rehearsal

‘Sensitive’ arms exhibited in parade rehearsalDay|Week