|

| Chinese Premier Li Keqiang speaks at a press conference after the closing meeting of the third session of China's 12th National People's Congress (NPC) at the Great Hall of the People in Beijing, capital of China, March 15, 2015. (Xinhua/Xie Huanchi) |

BEIJING, March 15 -- China is capable of preventing systemic or regional financial crises while allowing market-ruled liquidation in individual and isolated cases, Chinese Premier Li Keqiang said on Sunday.

Li made the remarks after the conclusion of the annual session of the National People's Congress, China's top legislature, in response to a question on financial risks in the world's second largest economy.

"It is true that there are individual and isolated cases of financial risks, but at the same time, we are fully capable of preventing systemic or regional financial crises," the premier said at a press conference.

Reassuring the market, he cited the facts that the Chinese economy continues to operate within the proper range and there is a fairly high saving rate in the country.

Regarding concerns over the potential risks which may arise from local government debts, the premier said more than 70 percent of local government debts are in the form of investment which have quite good prospect for yielding returns.

"We are also regulating these financing platforms to ensure that we keep the front door open while blocking the back door," he said.

The premier also clarified potential financial risks involving the banking system, pointing to "fairly high capital adequacy ratios and relatively ample provisions" with the country's banks.

"It is true that there are non-performing loans (NPLs) and the NPL ratios have picked up somewhat, but the NPL ratios in China are still quite low in the international context," he said.

While allowing the market to rule individual and isolated cases of financial risks, China will encourage the practice of balancing one's book in a market-based way so as to guard against possible ethics violations and raise people's awareness of risks, the premier said.

The Chinese authorities will also introduce the deposit insurance system this year and continue to develop a multiple-tiered capital market so as to lower companies' leverage ratio and help ensure financial services better serve the real economy, said the premier.

Day|Week

Tsinghua junior makes over 10,000 yuan a day by selling alumnae's used quilts

Tsinghua junior makes over 10,000 yuan a day by selling alumnae's used quilts Graduation photos of students from Zhongnan University

Graduation photos of students from Zhongnan University A school with only one teacher in deep mountains

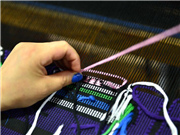

A school with only one teacher in deep mountains Glimpse of cultural heritage "Xilankapu"

Glimpse of cultural heritage "Xilankapu" Homemade cured hams in SW China

Homemade cured hams in SW China Breathtaking buildings of W. Sichuan Plateau

Breathtaking buildings of W. Sichuan Plateau Graduation photos of "legal beauties"

Graduation photos of "legal beauties" Top 10 most expensive restaurants in Beijing in 2015

Top 10 most expensive restaurants in Beijing in 2015