A continuing decline in global gold prices is more likely than a rebound in the near future, according to a yellow paper on the world economy released by the Chinese Academy of Social Science in Beijing on Wednesday.

The yellow paper analyzed the reasons for the drop in the gold prices from the following perspectives.

The sluggish recovery of the world economy and the expectation that Fed will exit quantitative easing (QE) from early 2014 have reduced current global inflationary pressures. Combined with a significant rise in U.S. 10-year bond yields, this means that U.S. domestic long-term real interest rates will rise significantly too, said the yellow paper.

In the immediately foreseeable future, the effective exchange rate of the U.S. dollar will remain strong due to the Fed’s QE exit and the corresponding inflow of short-term international capital to the U.S. from emerging markets. As a result, emerging market economies will slow the pace of diversification of reserve assets and their demand for gold reserves may decline.

Considering that the European debt crisis has now stabilized, and the financial market in Italy, which has large gold reserves, is relatively stable, the need to raise funds through the sale of gold reserves is not strong.

The probability of a financial crisis breaking out in emerging markets is low, according to the paper. Therefore, there is less likelihood that any substantial turmoil in global financial markets will push up gold prices.

Affected by weak global demand and the appreciation of U.S. dollar, current global crude oil prices remain stable, so the risk of conflict in Syria and Iran has declined.

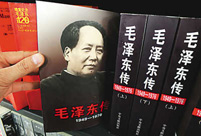

Commemorate 120th birth anniversary of Mao Zedong

Commemorate 120th birth anniversary of Mao Zedong Female soldiers of PLA Marine Corps in training

Female soldiers of PLA Marine Corps in training Chinese cities to have a very grey Christmas as smog persists

Chinese cities to have a very grey Christmas as smog persists China and U.S. - the national image in each other’s eyes

China and U.S. - the national image in each other’s eyes The Liaoning's combat capability tested in sea trial

The Liaoning's combat capability tested in sea trial Chinese pole dancing team show their moves in snow

Chinese pole dancing team show their moves in snow Rime scenery in Mount Huangshan

Rime scenery in Mount Huangshan Ronnie O'Sullivan: My children mean the world to me

Ronnie O'Sullivan: My children mean the world to me Shopping in Hong Kong: a different picture

Shopping in Hong Kong: a different picture SWAT conducts anti-terror raid drill

SWAT conducts anti-terror raid drill AK-47 inventor dies at 94

AK-47 inventor dies at 94 Mother practices Taiji with her son

Mother practices Taiji with her son  Crashed French helicopter salvaged

Crashed French helicopter salvaged Winter travels in Anhui

Winter travels in Anhui  Bird show opens to public in Calcutta, India

Bird show opens to public in Calcutta, IndiaDay|Week|Month