|

| A gold statue made to commemorate Year of the Horse (starting as of Jan 31, 2014) on display at a jewelry shop in Handan, Hebei province. China’s demand for gold jewelry jumped 29 percent in the third quarter of this year amid price fluctuations for the precious metal. Hao Qunying / For China Daily |

Despite a third quarter that saw global gold demand shrink 21 percent year-on-year to 868.5 metric tons, China's demand for gold jewelry jumped 29 percent year-on-year in the third quarter amid price fluctuations for the precious metal, the World Gold Council reported Thursday.

China was the world's top gold consumer in the third quarter, surpassing India, historically the world's largest gold consumer, the WGC said.

A number of factors contributed to China's growing appetite for gold jewelry, including lower gold prices, which made it more affordable for consumers; improving economic conditions; and strong brand promotion within the jewelry sector, said Cao Xiaorui, director of jewelry, Far East, for the WGC.

"In Shenzhen, China's largest gold jewelry exhibition and wholesale hub, about 200 new gold jewelry display centers opened in the third quarter, showing market players' strong confidence in the sector," Cao said.

Despite the high cost of opening such a center — with minimum input of 50 million yuan ($8.2 million) — many entrepreneurs shifted from other industries to the potentially lucrative sector, Cao said.

An expanding middle class in China will place more importance on jewelry style and design and attach less to the material value of gold, Cao added.

Continued growth in global demand and the strength of Asian gold demand overall reinforces a trend first seen at the beginning of 2013, as buoyant consumer markets balanced investment outflows, the WGC's gold demand trends report for the third quarter said.

The strong demand for jewelry, bars and coins in 2013 to date can be seen when compared against the first three quarters of previous years. As of the end of the third quarter, demand stood at 2,896 metric tons, 26 percent higher than the same year-to-date figure in 2012.

"Consistent with the first two quarters of 2013, the global gold market remains resilient, underpinned by a continuing shift in demand from West to East, strong demand in consumer categories and solid central bank and technology sectors," said Marcus Grubb, managing director, investment at the WGC.

European and US investors have exited gold positions in exchange-traded funds at record levels year-to-date.

Outflows from ETFs reached some 700 metric tons at the end of September, the largest level since 2004. The outflow reflects selling by Western gold investors, the WGC report said.

Albert Cheng, managing director, Far East, WGC, said investors remain confident in gold's risk-hedging function.

Government regulations in India curbed gold buying there. The country recorded a 32 percent drop in consumer demand compared with the same quarter last year due to higher duties imposed on imported gold. Year to date, however, demand has stayed robust, rising 19 percent compared with the first three quarters of 2012, following a buying surge sparked by two price drops earlier in 2013.

Central banks continue to be strong buyers of gold, albeit at a slower rate, with purchases totaling 93 metric tons, 17 percent down from the third quarter of 2012.

Demand in the technology sector was stable once again, totaling 103 metric tons, a rise of 1 percent on the same period last year, thanks to robust sales of smartphones and other electronic appliances.

Luxury-cars parade held in Dubai

Luxury-cars parade held in Dubai Special forces take tough training sessions

Special forces take tough training sessions Fire guts 22-storey Nigeria commercial building in Lagos

Fire guts 22-storey Nigeria commercial building in Lagos A girl takes care of paralyzed father for 10 years

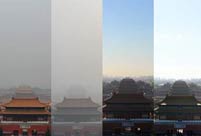

A girl takes care of paralyzed father for 10 years A record of Beijing air quality change

A record of Beijing air quality change In pictures: explosions occur in Taiyuan

In pictures: explosions occur in Taiyuan Live a harmonious life in Pu'er, SW China

Live a harmonious life in Pu'er, SW China Weekly Sports Photos

Weekly Sports Photos Gingko leaves turn brilliant golden yellow in Beijing

Gingko leaves turn brilliant golden yellow in Beijing Maritime counter-terrorism drill

Maritime counter-terrorism drill Loyal dog waits for master for six months

Loyal dog waits for master for six months Living in an urban village: 'Iron-digger' Xiong Sansan

Living in an urban village: 'Iron-digger' Xiong Sansan China in autumn: Kingdom of red and golden

China in autumn: Kingdom of red and golden National Geographic Traveler Photo Contest

National Geographic Traveler Photo Contest Weekly Sports Photos

Weekly Sports PhotosDay|Week|Month