'Jin' named the word of the year by cross-strait netizens

'Jin' named the word of the year by cross-strait netizens Chinese scientific expedition goes to build new Antarctica station

Chinese scientific expedition goes to build new Antarctica station

Chinese naval escort fleet conducts replenishment in Indian Ocean

Chinese naval escort fleet conducts replenishment in Indian Ocean 17th joint patrol of Mekong River to start

17th joint patrol of Mekong River to start China's moon rover, lander photograph each other

China's moon rover, lander photograph each other Teaming up against polluters

Teaming up against polluters

BEIJING, Dec. 26 -- Away from the big headlines about economic reform and rebalancing, China is witnessing a silent revolution — that of the rise of the consumer. Nowhere is this trend more visible than in the world of e-commerce. In 2011, China’s online retail purchases surpassed Japan’s. The following year, its online retail penetration hit 16 percent, cruising past that of the United States.

As growing affluence fuels aspirations for a better lifestyle, China’s consumers are shedding their generations-old inclination to save and are starting to spend. This is just what policy makers, not just in China but around the world, want to hear. China is trying to wean the world’s second-largest economy away from its reliance on large-scale investment as a driver of growth, and businesses worldwide are looking for new consumer markets as the West deleverages.

What is new about China’s emerging consumer class, though, is that it is becoming increasingly comfortable with using online websites to make retail purchases. Almost 600 million potential consumers have access to the Internet in the country today, more than twice the number in the US. Internet users have doubled in China over the past five years. Of these, 80 percent access the Internet through smartphones and other kinds of wireless devices.

Our recent study shows that the expansion and ease of Internet usage thanks to the spread of mobile devices, combined with the rapid development of supporting infrastructure, are driving China’s e-commerce market toward an inflection point. As the industry takes off, it is set to boost the profitability of not just top e-commerce businesses but also that of their service providers such as logistics companies, payment solutions providers and social-networking platforms.

Nevertheless, the ride has not been all smooth thus far, which probably explains the still-low valuations of even the industry leaders, despite strong underlying growth. The sector has undergone two years of consolidation, which has weeded out some of the smaller players and dimmed the appetite of venture capital firms; some firms offering services across the e-commerce value chain have run into cash-flow problems, and the “group-buy” model — where websites offer products at discounts when a minimum number of buyers make the purchase — has just not clicked.

As the industry emerges from the shakeout, many survivors are showing signs of breaking even. It is now becoming clear that China’s e-commerce market favors larger companies with strong user traffic and committed long-term strategies. Specifically, the winners are likely to be three types of companies: (1) e-commerce platforms with massive self-generating user traffic, (2) logistics-driven e-commerce firms and (3) companies with unique business models or niche products.

E-commerce companies need to manage their supply chains efficiently if they are to offer products at competitive prices and deliver them to customers quickly. The first step, though, is to have effective channels to acquire new users. Thus, the first category of likely winners emerging from the industry shakeout includes mobile search engines and social-networking, communications and content-driven media platforms. These firms typically have effective plans for revenue generation through advertisements or by offering themselves as marketing gateways for e-commerce. Based on the US experience, these companies should see profitability rising as marketing expenses to acquire new users decline over the longer term.

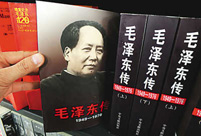

Commemorate 120th birth anniversary of Mao Zedong

Commemorate 120th birth anniversary of Mao Zedong Female soldiers of PLA Marine Corps in training

Female soldiers of PLA Marine Corps in training Chinese cities to have a very grey Christmas as smog persists

Chinese cities to have a very grey Christmas as smog persists China and U.S. - the national image in each other’s eyes

China and U.S. - the national image in each other’s eyes The Liaoning's combat capability tested in sea trial

The Liaoning's combat capability tested in sea trial Chinese pole dancing team show their moves in snow

Chinese pole dancing team show their moves in snow Rime scenery in Mount Huangshan

Rime scenery in Mount Huangshan Ronnie O'Sullivan: My children mean the world to me

Ronnie O'Sullivan: My children mean the world to me Shopping in Hong Kong: a different picture

Shopping in Hong Kong: a different picture Winter travels in Anhui

Winter travels in Anhui  Bird show opens to public in Calcutta, India

Bird show opens to public in Calcutta, India AK-47 inventor dies at 94

AK-47 inventor dies at 94 Crashed French helicopter salvaged

Crashed French helicopter salvaged Mother practices Taiji with her son for five years

Mother practices Taiji with her son for five years SWAT conducts anti-terror raid drill

SWAT conducts anti-terror raid drillDay|Week|Month