|

|

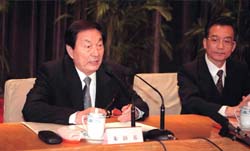

On January 25, Premier Zhu Rongji called for greater efforts to reform and straighten the banking sector in order to better serve the national economy. Zhu told a national banking, securities and insurance conference that strict measures must be taken to improve management and supervision to secure a safe, efficient and stable banking system. The banking sector and the nation's economic performance are inseparably linked. The banking industry has not only succeeded in weathering the Asian financial crisis, but also offset risks suffered by some financial institutions, the premier said. Banking, securities and insurance sectors have contributed greatly to economic reform and development, as well as social stability, he said, adding that the country has made major progress in banking reform with a modern banking organization, market and supervision system taking shape. However, Zhu pointed that there are still many unresolved problems and hidden troubles that may lead to financial crisis. Zhu stressed that China's monetary policy should be strengthened in an effort to boost domestic demand, and improve economic structures and efficiency. The banking sector should improve services and provide strong support for national economic development and reform of state-owned enterprises. Strict management and supervision are key to the banking, securities, and insurance sectors, Zhu said, calling on every banking institution, every employee to strictly abide to management procedures, financial laws, regulations, and discipline. The premier urged the banking sector to strive to work honestly and fight corruption. Special measures should be taken to attract talent, especially from overseas. |

Please visit People's Daily Online --- http://www.peopledaily.com.cn/english/