Cherry blossoms reach peak bloom in Washington D.C.

Cherry blossoms reach peak bloom in Washington D.C.

Top Chinese fashion icons in foreigners' eyes

Top Chinese fashion icons in foreigners' eyes

Asia's largest business aviation exhibition to be held in Shanghai

Asia's largest business aviation exhibition to be held in Shanghai

World's top-rated luxury hotels

World's top-rated luxury hotels

Wu Jing, Xie Nan to hold wedding on May

Wu Jing, Xie Nan to hold wedding on May

London Cake International attracts tourists

London Cake International attracts tourists

Let's dance in harmonic Shaanxi

Let's dance in harmonic Shaanxi

Christie's to auction dazzling diamonds

Christie's to auction dazzling diamonds

'Model husband' shatters image of love

'Model husband' shatters image of love

Can animals smile? Or put on a happy face

Can animals smile? Or put on a happy face

|

| (Graphics: GT) |

(Graphics: GT)

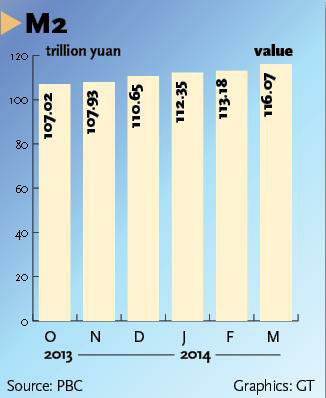

China's broad money supply grew 12.1 percent in March from a year earlier, official data showed Tuesday, the slowest pace in more than a decade as a result of weak deposit growth and liquidity, which fueled market expectation of monetary easing amid a cooling economy.

Broad money supply, also known as M2, is a measure of money supply that includes cash and checking deposits (M1) as well as assets that can be quickly converted into cash or checking deposits.

The People's Bank of China (PBC), the central bank, said in a statement that M2 reached 116.07 trillion yuan ($18.8 trillion) by the end of March.

The slower growth of M2 in the first quarter is greatly attributed to the high base effect - the high growth of the broad money supply in the first three months of 2013, Sheng Songcheng, financial survey and statistics chief at the PBC, told a media briefing.

The M2 money supply growth will likely be low in the beginning but higher later this year, and the growth rate will rebound in the second quarter and possibly reach or even exceed 13 percent, Song said.

Chinese banks issued 1.05 trillion yuan worth of new loans in March from 644.5 billion yuan a month earlier. Total social financing, a broad measure of liquidity in the economy, reached 2.07 trillion yuan from 939 billion yuan in February.

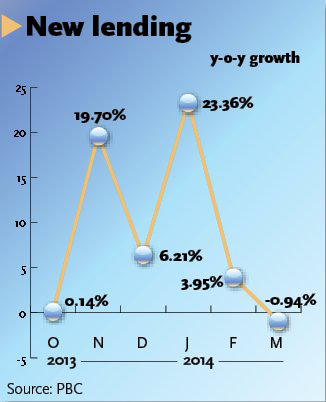

Despite a rebound in number, the central bank's data indicated a slower trend in credit and deposit growth. New loan growth in March fell 0.94 percent year-on-year, while yuan deposit growth fell 1.1 percentage points from February and 2.4 percentage points from December 2013.

In response to the less vigorous credit growth data, banking shares led the slump in China's A-share market on Tuesday. The benchmark Shanghai Composite Index and Shenzhen Component Index fell by 1.4 percent and 1.76 percent respectively at market close from the previous trading day.

The slowdown of credit growth is mainly due to the central bank's tightening control of shadow banking activities, Liu Ligang, chief China economist at ANZ Banking Corporation, told the Global Times.

Sliding deposit growth suggests that corporations may have difficulty in collecting payments from customers amid the cooling economy, Liu said.

The central bank sustained a relatively tight monetary policy aimed to force corporations and local governments to deleverage and cut debt ratio out of fears for rising financial risks, he noted.

China's broad money supply is about 200 percent of its GDP, one of the world's highest, mainly driven by the 4-trillion-yuan stimulus package launched in 2009-10.

Excessive money stocks pushed up asset prices and led to swelling corporate and local government debts, leaving the country's monetary policymakers in a dilemma whether to trade off between a reined-in money supply and the ailing economy.

Amid a slackening economy, there has been market speculation that the PBC may cut the reserve requirement ratio (RRR) of commercial banks to release additional money into the economy.

Relatively tight money supply over the past two years has pushed up the financing cost of corporations.

Cutting the RRR and increasing money supply will lower a corporation's financing cost and will make it easier to push forward the interest rate liberalization, Liu said.

March's money and credit data is in line with other recent signs of slower growth momentum, Zhang Zhiwei, chief China economist at Nomura Securities, told the Global Times in a research note on Tuesday.

"We maintain our view that GDP slowed to 7.3 percent year-on-year in the first quarter and will slow further to 7.1 percent in the second quarter, partly due to weak momentum in the property sector, and continue to believe that the government will have to ease policy further, particularly on the monetary side," Zhang wrote.

China is scheduled to unveil on Wednesday its official data on first quarter GDP growth.

The World Bank trimmed recently its 2014 forecast for China's GDP growth to 7.6 percent from 7.7 percent previously, citing a weak industrial production and exports data in the first two months of this year.

"The central bank has been fine-tuning its monetary policy slightly since early this year. Market liquidity is relatively abundant compared with the same period last year," Lian Ping, chief economist at the Bank of Communications, told the Global Times on Tuesday.

Lian projected that the central bank will continue its open market operations to maintain a steady and moderate level of liquidity, and the possibility of the central bank cutting RRR cannot be excluded.

Premier Li Keqiang said at the Boao Forum for Asia on Thursday that China will not take forceful short-term stimulus measures in response to temporary economic fluctuations but will focus more on medium and long-term healthy development.

Central bank governor Zhou Xiaochuan also said at the forum that a low inflation rate is key for PBC monetary control. If economic growth is too deviated from the target, the central bank will make slight changes to its monetary policy.

A bite of China II whets the appetite

A bite of China II whets the appetite Chinese frigate completes its 14th escort mission

Chinese frigate completes its 14th escort mission Let's dance in wealthy Shaanxi

Let's dance in wealthy Shaanxi A date with 798: feel the art around you

A date with 798: feel the art around you 3D-printed houses built in Shanghai

3D-printed houses built in Shanghai World largest scale of umbrella dance

World largest scale of umbrella dance Cherry blossoms reach peak bloom in Washington D.C.

Cherry blossoms reach peak bloom in Washington D.C. Red terraced fields in Dongchuan of Yunnan

Red terraced fields in Dongchuan of Yunnan Presentation ceremony of 33rd Hong Kong Film Awards

Presentation ceremony of 33rd Hong Kong Film Awards The backstage of the Fashion Week

The backstage of the Fashion Week College students in Han costumes

College students in Han costumes Postgraduate works as waitress

Postgraduate works as waitress Life in a Lahu village in Yunnan

Life in a Lahu village in Yunnan An orphan’s wedding

An orphan’s wedding Hollywood documentary brings Diaoyu Islands truth to new audience

Hollywood documentary brings Diaoyu Islands truth to new audienceDay|Week|Month