'Jin' named the word of the year by cross-strait netizens

'Jin' named the word of the year by cross-strait netizens Chinese scientific expedition goes to build new Antarctica station

Chinese scientific expedition goes to build new Antarctica station

Chinese naval escort fleet conducts replenishment in Indian Ocean

Chinese naval escort fleet conducts replenishment in Indian Ocean 17th joint patrol of Mekong River to start

17th joint patrol of Mekong River to start China's moon rover, lander photograph each other

China's moon rover, lander photograph each other Teaming up against polluters

Teaming up against polluters

BEIJING, Jan. 2 -- Though the gains on the last trading day of 2013 did not reverse the losing trend of the Chinese stock market in 2013, a rebound in 2014 is expected as the country deepens reforms.

The benchmark Shanghai Composite Index rose 0.88 percent to finish at 2,115.98 on Tuesday, with a drop of 6.75 percent from the last trading day of 2012, marking another declining year in the past half decade.

Shares shrank with repeated rebounds and slumps. The benchmark Shanghai Composite Index hit 1,849.65 on June 25, the lowest of 2013, and dropped 13.97 percent in June -- the biggest monthly loss since 2009.

Slowing economic expansion and liquidity tensions were weighed heavily in the disappointing year-round performance, according to a Shanghai Securities News report on Thursday.

The seven-day Shanghai Interbank Offered Rate (Shibor), which measures the rate at which Chinese banks lend to one another, hit a record high of over 13 percent in late June, while the overnight Shibor once hit an astonishing rate of 30 percent on June 20.

Bucking the trend, the ChiNext Index, a Nasdaq-style board tracking China's growth enterprises, had soared by 82.73 percent year on year by the end of 2013, despite a temporary dive at the beginning of last month after a central announcement to restart IPO issuance, which had been put on hold on the country's stock markets since October 2012.

The report said that China's ongoing reforms and economic transformation provide no solid basis for a bullish market in the near future, but investors will have increasing opportunities as China pursues a new economic method of innovation and high efficiency.

CITIC Securities and Shenyin & Wanguo Securities forecast that China's gross domestic product (GDP) growth will stand at 7.5 percent in 2014, putting greater pressure on deepening reforms.

However, more potential will emerge in the information technology, high-end devices and environmental protection sectors, while reforms in land, state-owned assets and free trade zones will become the new crucial factors in pushing forward economic development, the report said.

According to the report, several securities dealers estimated that the main boards will rebound by over 10 percent in 2014.

Shenyin & Wanguo Securities forecast that the Shanghai Composite Index will fluctuate between 2,000 and 2,600 points and the ChiNext Index will fluctuate between 1,000 and 1,500 points this year. The CICC also said A shares will gain over 10 percent -- the first time since 2010.

However, many institutions mentioned worries over economic downturn that may impact market performance.

Changjiang Securities pointed out it is very likely to see new high or new low results in the country's stock indices because of outside influences.

CITIC said that the deepening reforms will vitalize A shares, and sectors related to state-owned enterprises, opening-up and household registration are promising.

"The pains due to reforms will still exist," CITIC added. "Credit risk and liquidity are keys in stock market performance."

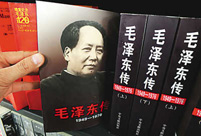

Commemorate 120th birth anniversary of Mao Zedong

Commemorate 120th birth anniversary of Mao Zedong Female soldiers of PLA Marine Corps in training

Female soldiers of PLA Marine Corps in training Chinese cities to have a very grey Christmas as smog persists

Chinese cities to have a very grey Christmas as smog persists China and U.S. - the national image in each other’s eyes

China and U.S. - the national image in each other’s eyes The Liaoning's combat capability tested in sea trial

The Liaoning's combat capability tested in sea trial Chinese pole dancing team show their moves in snow

Chinese pole dancing team show their moves in snow Rime scenery in Mount Huangshan

Rime scenery in Mount Huangshan Ronnie O'Sullivan: My children mean the world to me

Ronnie O'Sullivan: My children mean the world to me Shopping in Hong Kong: a different picture

Shopping in Hong Kong: a different picture Yearender: Animals' life in 2013

Yearender: Animals' life in 2013 Hello 2014 - Chinese greet the New Year

Hello 2014 - Chinese greet the New Year Chocolate 'Terracotta Warriors' appear

Chocolate 'Terracotta Warriors' appear  Top 10 domestic news of 2013

Top 10 domestic news of 2013 Red crabs begin annual migrations in Australia

Red crabs begin annual migrations in Australia Artifacts retrieved from West Zhou Dynasty

Artifacts retrieved from West Zhou DynastyDay|Week|Month