'Jin' named the word of the year by cross-strait netizens

'Jin' named the word of the year by cross-strait netizens Chinese scientific expedition goes to build new Antarctica station

Chinese scientific expedition goes to build new Antarctica station

Chinese naval escort fleet conducts replenishment in Indian Ocean

Chinese naval escort fleet conducts replenishment in Indian Ocean 17th joint patrol of Mekong River to start

17th joint patrol of Mekong River to start China's moon rover, lander photograph each other

China's moon rover, lander photograph each other Teaming up against polluters

Teaming up against polluters

BEIJING, Jan. 2 -- China may see a record high number of new stock listings in 2014 after the country's regulator resumed initial public offerings (IPOs), PricewaterhouseCoopers (PwC) said on Thursday.

The regulator lifted a one-year ban on IPOs, which has given 11 companies the green light to go public in the last three days.

The resumption signaled the launch of a reform package rolled out to reignite market confidence in one of the world's worst performers.

PwC expects that about 300 new A-share IPOs will be launched in 2014, which could raise 250 billion yuan (41.3 billion U.S. dollars) in the market. The auditing network said two or three IPOs could receive funding of over 10 billion yuan each on the Shanghai Stock Exchange.

"The fund raised on average is expected to decline. The price earning ratio will also be lower than those in previous years," said Frank Lyn, PwC Chinese mainland & Hong Kong Markets Leader.

More than 700 companies are queuing for IPO approval as the regulator had shut down the IPO pipeline to toughen measures against the fraud and misrepresentations that beset Chinese stock markets.

The China Securities Regulatory Commission (CSRC) last month announced significant changes to IPO issuance, allowing underwriters and issuers themselves to have a bigger say in launching IPOs.

The decision came about two weeks after Chinese leaders promised an economic overhaul package that gives the market a "decisive role" in allocating resources.

The CSRC said the IPO issuance will shift from approval-based to registration-based. New listing candidates currently have to go through multiple rounds of reviews that can take several years to receive approval from the CSRC.

Under the registration-based system, the CSRC will focus on requirements for information disclosure. The timing of new share issuance and how to issue shares will be determined by the market.

The reform would also further clarify the liabilities of the new share issuers, IPO sponsors, accounting and law firms in IPO issuance.

"These reform measures will result in a better supervised and healthier capital market. This will instill confidence in both enterprises and investors, while creating systemic guarantees for the market," Lyn said.

The resumption of IPOs on the Chinese mainland would not have a big impact on the Hong Kong stock market, according to PwC.

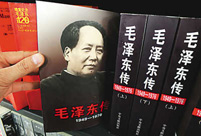

Commemorate 120th birth anniversary of Mao Zedong

Commemorate 120th birth anniversary of Mao Zedong Female soldiers of PLA Marine Corps in training

Female soldiers of PLA Marine Corps in training Chinese cities to have a very grey Christmas as smog persists

Chinese cities to have a very grey Christmas as smog persists China and U.S. - the national image in each other’s eyes

China and U.S. - the national image in each other’s eyes The Liaoning's combat capability tested in sea trial

The Liaoning's combat capability tested in sea trial Chinese pole dancing team show their moves in snow

Chinese pole dancing team show their moves in snow Rime scenery in Mount Huangshan

Rime scenery in Mount Huangshan Ronnie O'Sullivan: My children mean the world to me

Ronnie O'Sullivan: My children mean the world to me Shopping in Hong Kong: a different picture

Shopping in Hong Kong: a different picture Yearender: Animals' life in 2013

Yearender: Animals' life in 2013 Hello 2014 - Chinese greet the New Year

Hello 2014 - Chinese greet the New Year Chocolate 'Terracotta Warriors' appear

Chocolate 'Terracotta Warriors' appear  Top 10 domestic news of 2013

Top 10 domestic news of 2013 Red crabs begin annual migrations in Australia

Red crabs begin annual migrations in Australia Artifacts retrieved from West Zhou Dynasty

Artifacts retrieved from West Zhou DynastyDay|Week|Month