'Jin' named the word of the year by cross-strait netizens

'Jin' named the word of the year by cross-strait netizens Chinese scientific expedition goes to build new Antarctica station

Chinese scientific expedition goes to build new Antarctica station

Chinese naval escort fleet conducts replenishment in Indian Ocean

Chinese naval escort fleet conducts replenishment in Indian Ocean 17th joint patrol of Mekong River to start

17th joint patrol of Mekong River to start China's moon rover, lander photograph each other

China's moon rover, lander photograph each other Teaming up against polluters

Teaming up against polluters

BEIJING, Dec. 28-- The yuan strengthened to a 20-year high against the US dollar yesterday after the central bank set a record reference rate that signals support for further appreciation of the Chinese currency.

The yuan touched 6.067 per US dollar on the spot market yesterday morning, its highest level since China unified official and market rates at the end of 1993. The yuan had reached 6.0702 on Monday.

The yuan closed at 6.086 yesterday, 0.1 percent stronger than on Thursday.

The rise came after the People’s Bank of China boosted the central parity rate 0.17 percent to 6.1050 per US dollar, the strongest since the yuan’s peg to the greenback was lifted in July 2005. The yuan is allowed to be traded within 1 percent on either side of the parity rate.

The central bank has raised the parity rate by 3 percent this year. That compared with a nearly flat performance last year.

A Deutsche Bank report said the yuan may continue to rise in 2014 driven by corporate money flows as global growth gradually recovers and China’s exports pick up.

Central bank data showed financial institutions bought a net 397.9 billion yuan (US$65.6 billion) worth of foreign exchange in November. It was the third-highest total this year and indicated an abundant inflow of foreign capital.

Traders said the central bank seemingly withdrew efforts to tame appreciation, but transactions have dropped as the year-end approaches, distorting the market rate to some extent.

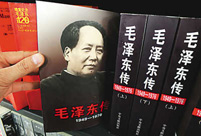

Commemorate 120th birth anniversary of Mao Zedong

Commemorate 120th birth anniversary of Mao Zedong Female soldiers of PLA Marine Corps in training

Female soldiers of PLA Marine Corps in training Chinese cities to have a very grey Christmas as smog persists

Chinese cities to have a very grey Christmas as smog persists China and U.S. - the national image in each other’s eyes

China and U.S. - the national image in each other’s eyes The Liaoning's combat capability tested in sea trial

The Liaoning's combat capability tested in sea trial Chinese pole dancing team show their moves in snow

Chinese pole dancing team show their moves in snow Rime scenery in Mount Huangshan

Rime scenery in Mount Huangshan Ronnie O'Sullivan: My children mean the world to me

Ronnie O'Sullivan: My children mean the world to me Shopping in Hong Kong: a different picture

Shopping in Hong Kong: a different picture SWAT conducts anti-terror raid drill

SWAT conducts anti-terror raid drill AK-47 inventor dies at 94

AK-47 inventor dies at 94 Mother practices Taiji with her son

Mother practices Taiji with her son  Crashed French helicopter salvaged

Crashed French helicopter salvaged Winter travels in Anhui

Winter travels in Anhui  Bird show opens to public in Calcutta, India

Bird show opens to public in Calcutta, IndiaDay|Week|Month