BEIJING, Dec. 19 -- China will promote a mixed-ownership economy by diversifying the shareholding structure of state-owned enterprises (SOEs), an official with the country's SOEs regulator said Thursday.

Huang Shuhe, vice chairman of the State-owned Assets Supervision and Administration Commission (SASAC), told a press conference that China will speed up the transformation of SOEs, especially parent companies, into joint-stock firms. It will also improve the shareholding structure of SOEs.

Some SOEs, state-owned capital investment companies and capital operating firms that are vital to national security will be wholly invested by state-owned capital, according to Huang.

"Absolute majority shares can be held by state-owned capital for SOEs in major industries and key fields that are the lifeblood of the economy," Huang said.

State capital can hold a relative majority of shares for important SOEs in pillar sectors and new- and high-technology industries.

It can hold minority shares in or totally exit from SOEs that do not need to be controlled by state capital and whose majority shares can be held by capital from other sources.

"We will encourage qualified SOEs to reorganize and become listed through various forms, and SOEs that are not qualified for going public can diversify shareholding by introducing different kinds of investors," according to Huang.

Strategic investors with capital, technology and managerial advantages, as well as institutional investors such as social security funds, insurance funds and private equity funds are encouraged to participate in the restructuring and reorganization of SOEs.

A policy document released last month by the Communist Party of China said the country will promote the development of the economy with mixed ownership and allow non-state capital to hold shares in projects invested by state-owned capital.

Mixed ownership is beneficial for extending state capital's functions, maintaining and increasing the value of state capital and raising its competitiveness.

It will help with the improvement of SOEs' governance structure and provide more room for the development of private capital. It will also promote integration of state capital and private capital.

Huang said the commission will prioritize the work to develop a mixed ownership economy. "Since its establishment, the SASAC has actively encouraged SOEs to introduce private capital during their reorganization."

By the end of 2012, 378 listed companies were controlled by centrally administered SOEs and their subsidiaries, while the stake of those firms held by the non-state sector accounted for over 53 percent of the total.

Meanwhile, non-state capital held more than a 60-percent stake in 681 listed companies controlled by locally-administered SOEs by the end of last year.

Huang said the commission will deepen the reform of SOEs management mechanism and further improve the modern corporate system.

It will also strengthen state-owned assets management by steering the emphasis of supervision from SOEs' operations to the use of state-owned capital and raising the proportion of state capital earnings handed over to central finance.

The proportion of state-owned capital gains handed to public finance will reach 30 percent by 2020, up from 5 to 15 percent for most SOEs.

"We will promote the optimal allocation of state-owned capital so that it can better serve the national development strategy," Huang added.

People prepare for upcoming 'Chunyun'

People prepare for upcoming 'Chunyun'  Highlights of Beijing int'l luxury show

Highlights of Beijing int'l luxury show Record of Chinese expressions in 2013

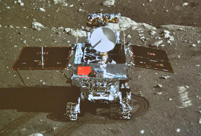

Record of Chinese expressions in 2013 China's moon rover, lander photograph each other

China's moon rover, lander photograph each other 17th joint patrol of Mekong River to start

17th joint patrol of Mekong River to start Spring City Kunming witnesses snowfall

Spring City Kunming witnesses snowfall Heritage of Jinghu, arts of strings

Heritage of Jinghu, arts of strings Weekly Sports Photos

Weekly Sports Photos PLA elite units unveiled

PLA elite units unveiled  PLA elite units unveiled

PLA elite units unveiled  Chinese scientific expedition team

Chinese scientific expedition team  Heritage of Jinghu, arts of strings

Heritage of Jinghu, arts of strings The unchanged flavor of changing Beijing

The unchanged flavor of changing Beijing Miss Philippines crowned Miss International

Miss Philippines crowned Miss International Bolt throws down bus challenge in China

Bolt throws down bus challenge in ChinaDay|Week|Month