BEIJING, Nov. 10 -- China’s exports rebounded sharply in October from a September slump in a sign that the economy was stabilizing.

Exports jumped 5.6 percent from a year earlier last month to US$185.4 billion, reversing the 0.3 percent decline in September, the General Administration of Customs said yesterday.

Imports expanded 7.6 percent to US$154.3 billion, up from an increase of 7.4 percent a month earlier. They created a trade surplus of US$31.1 billion, far above September’s figures of US$15.2 billion.

“China’s export growth in October beat expectations,” said Zhou Hao, an economist at Australia & New Zealand Banking Group Ltd. “It was a result of rising demand from the United States, Europe and ASEAN economies.”

By destination, exports to major advanced economies all grew. Shipments to the US rose 8.1 percent year on year in October, faster than 4.2 percent in September. Exports to the European countries expanded 12.7 percent from a drop of 1 percent, and those to the ASEAN countries added 10.7 percent from 9.8 percent.

By product, exports of mechanical and electrical goods grew by 3.7 percent last month from the loss of 0.7 percent a month earlier. Exports of some traditional labor-intensive sectors picked up rapidly, including footwear, lamps and suitcases as the external demand swelled with the arrival of the peak season for shopping in Western countries.

Zhou warned the surge in trade surplus may lead to renewed pressure on the appreciation of the yuan, and the market expectation for a stronger yuan was still strong.

But risks for China’s exports remained. Shen Jianguang, an analyst with Mizuho Securities Asia, said October’s export growth “does not change the weakening trend.”

“We believe the outlook for exports remains challenging,” Shen said in a research note, citing the lack of a robust global demand recovery, the yuan’s appreciation and higher production costs.

Besides, there has been a growing number of trade disputes.

Allen Cao, vice general manager of the Shanghai Tsingshan Mining Investment Co Ltd, a stainless steel producer, said his company would have suffered a huge loss if it had not bought the export credit insurance, a product designed to protect companies’ foreign receivables.

A firm in Vietnam, with business ties with Tsingshan for four years, refused to pay US$12 million a few months ago because of the fluctuating exchange rates that ate into the company’s profits. Such cases were on the rise.

Luckily, the potential loss of Tsingshan has largely been covered by the Shanghai Branch of the China Export & Credit Insurance Corporation which offered export credit insurance.

The external sector remained important as it involved 100 million jobs, Premier Li Keqiang said ahead of today’s opening of the third plenary session of the Chinese Communist Party Central Committee, suggesting that the authorities were concerned about the country’s declining trade competitiveness.

But global headwinds could block further improvement in exports. Export contracts signed at the recent China Import and Export Fair fell to their lowest in four years, indicating an not-so-optimistic future.

In the first 10 months, China’s trade expanded 7.6 percent from a year earlier to US$3.39 trillion, with a surplus of US$200.4 billion, the Customs data showed.

Other key economic data, including inflation, industrial, investment and retail sales, will be released today that will give a broader picture of the economy.

Luxury-cars parade held in Dubai

Luxury-cars parade held in Dubai Special forces take tough training sessions

Special forces take tough training sessions Fire guts 22-storey Nigeria commercial building in Lagos

Fire guts 22-storey Nigeria commercial building in Lagos A girl takes care of paralyzed father for 10 years

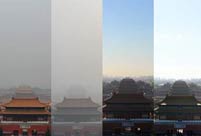

A girl takes care of paralyzed father for 10 years A record of Beijing air quality change

A record of Beijing air quality change In pictures: explosions occur in Taiyuan

In pictures: explosions occur in Taiyuan Hello! Horror Halloween Celebration!

Hello! Horror Halloween Celebration!  The catwalk to the world of fashion

The catwalk to the world of fashion  Cruise trip to Taiwan

Cruise trip to Taiwan  Maritime counter-terrorism drill

Maritime counter-terrorism drill Loyal dog waits for master for six months

Loyal dog waits for master for six months Oriental education or western education?

Oriental education or western education? China in autumn: Kingdom of red and golden

China in autumn: Kingdom of red and golden National Geographic Traveler Photo Contest

National Geographic Traveler Photo Contest Chinese screen goddesses from Beijing Film Academy

Chinese screen goddesses from Beijing Film Academy Day|Week|Month